Precarious Position for Energy Stocks

During volatile times in the investment world, seized upon by the sharp minds of savvy traders, opportunities often present themselves in droves. This is the case with the oversold stocks in the energy sector now staring investors in the eye. The Relative Strength Index (RSI), a critical momentum indicator, is the compass navigating traders through stormy weather. When the RSI falls below 30, it signals a stock is wallowing in oversold territory, making it a prime contender for a potential price reversal.

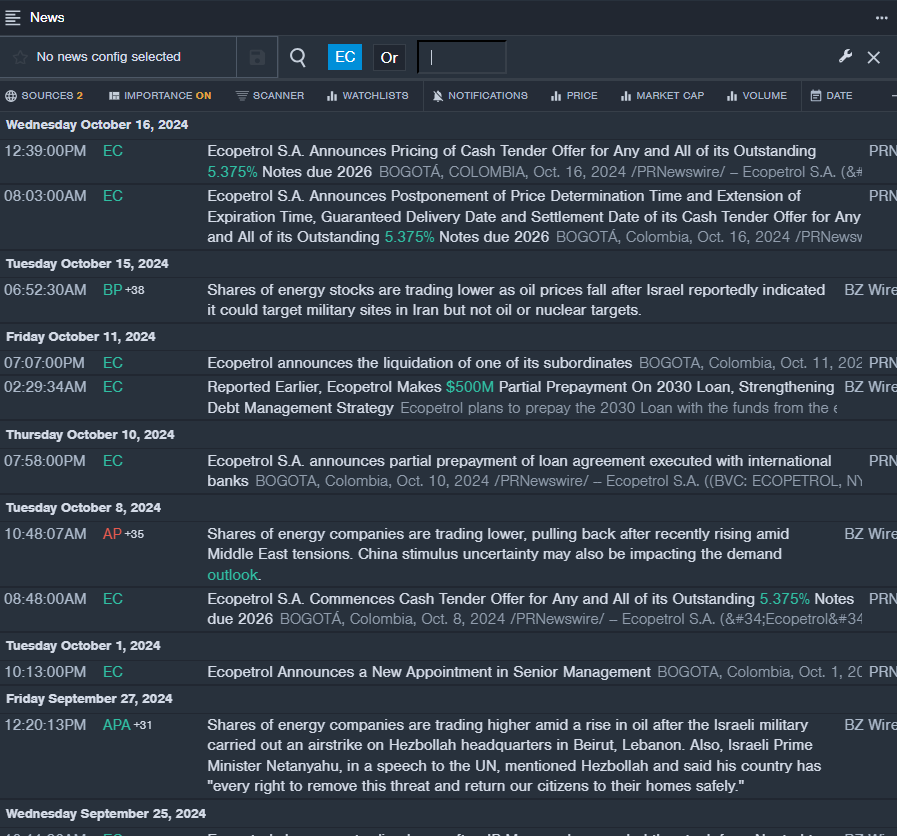

Ecopetrol SA: Awaiting Liftoff

Kicking off our list with Ecopetrol SA, the recent woes of this company have been laid bare, with shares stumbling by approximately 11% over the past week alone. Dropping to a 52-week low of $8.13, Ecopetrol seems to be treading troubled waters. The RSI sits tantalizingly low at 26.20, signaling a probable inflection point. Could this be the calm before the storm for Ecopetrol?

Torm PLC: Ready for Rebound?

Next up to bat is Torm PLC, weathering a recent storm that saw its stock plummet by a daunting 17% in the last month. With a 52-week low of $26.10, Torm PLC is facing its own set of challenges. However, with an RSI of 27.08, a sense of anticipation lingers in the air. As the tides of fortune change, could Torm PLC be on the brink of a resurgence?