Unlocking Opportunities in Oversold Stocks

For investors prowling the market for hidden treasures, the consumer staples sector is currently a gold mine brimming with undervalued gems waiting to be unearthed. These unpolished stocks that are often overlooked in the glitz and glam of the market present an alluring opportunity to acquire assets on the cheap.

The Art of Reading the RSI

The Relative Strength Index (RSI) acts as a financial divining rod, helping traders discern the underlying strength or weakness of a stock. By comparing a stock’s performance on bullish and bearish days, the RSI offers a glimpse into its potential short-term trajectory. When this index dips below the 30-mark, the asset is deemed oversold, marking a potential entry point for savvy investors looking to capitalize on a rebound.

Current Stars in the Oversold Galaxy

In the current constellation of oversold stocks, two stand out as potential shooting stars:

Farmmi Inc (FAMI)

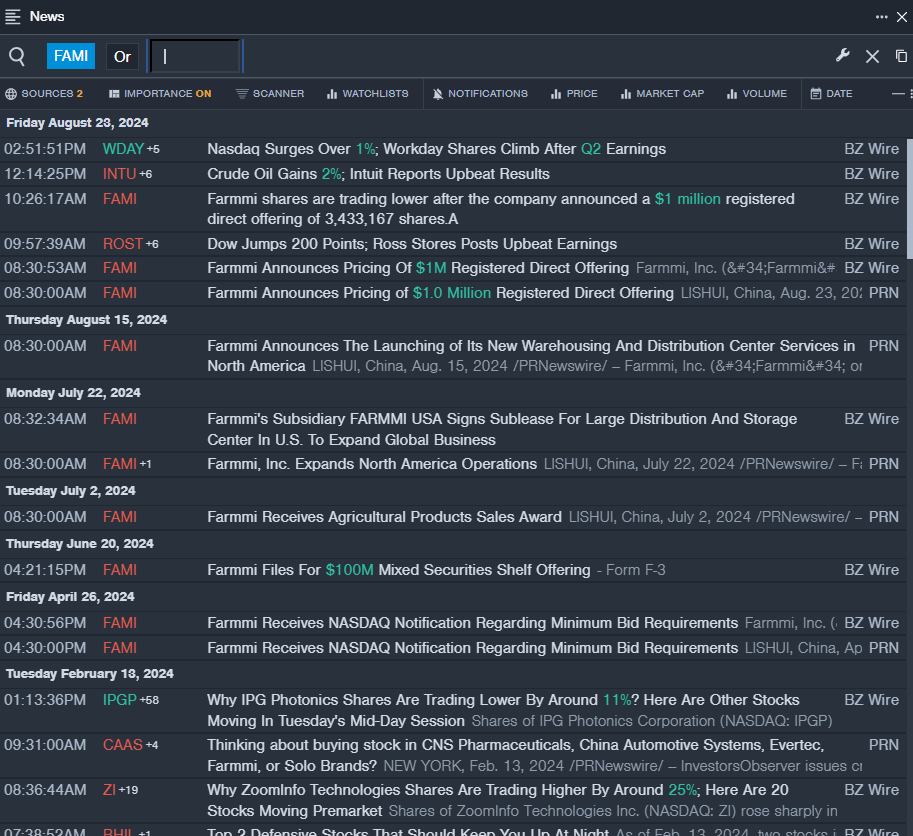

- With Farmmi Inc making waves in the market with a $1 million registered direct offering of shares, the company has seen its stock plummet by a staggering 61% in the past month, hitting a 52-week low of $0.17. The RSI for FAMI currently hovers at 29.98, underscoring its oversold status.

- The recent price action for Farmmi saw a 5.1% drop, closing at $0.22 on a gloomy trading day.

elf Beauty Inc (ELF)

- In a similar downtrend, elf Beauty Inc witnessed a 30% decline in its shares over the past month, with a 52-week low of $88.47. Piper Sandler analyst Korinne Wolfmeyer remained optimistic about elf Beauty, maintaining an Overweight rating despite lowering the price target. The RSI for ELF stands at 28.33, signaling a compelling entry point for discerning investors.

- elf Beauty’s recent price action saw a marginal decline of 0.7%, closing at $112.43 amid market turbulence.

As these stocks present themselves as ripe for the picking, investors are keeping a keen eye on developments, leveraging tools like real-time news feeds and charting resources to navigate the tumultuous waters of the market.

By identifying these prime opportunities in the oversold market, investors can position themselves strategically for potential upside in the coming quarters.