The consumer discretionary sector is like a sea of opportunities, with oversold stocks emerging as beacons of hope for savvy investors.

RSI, the reliable momentum indicator, serves as a compass in this volatile waters, signaling when a stock ventures into bargain territory. A stock is often dubbed “oversold” when its RSI falls below 30, offering promise to those seeking value amidst turmoil.

Let’s set sail and explore the latest list of major oversold players in the consumer sector, riding the waves of undervaluation.

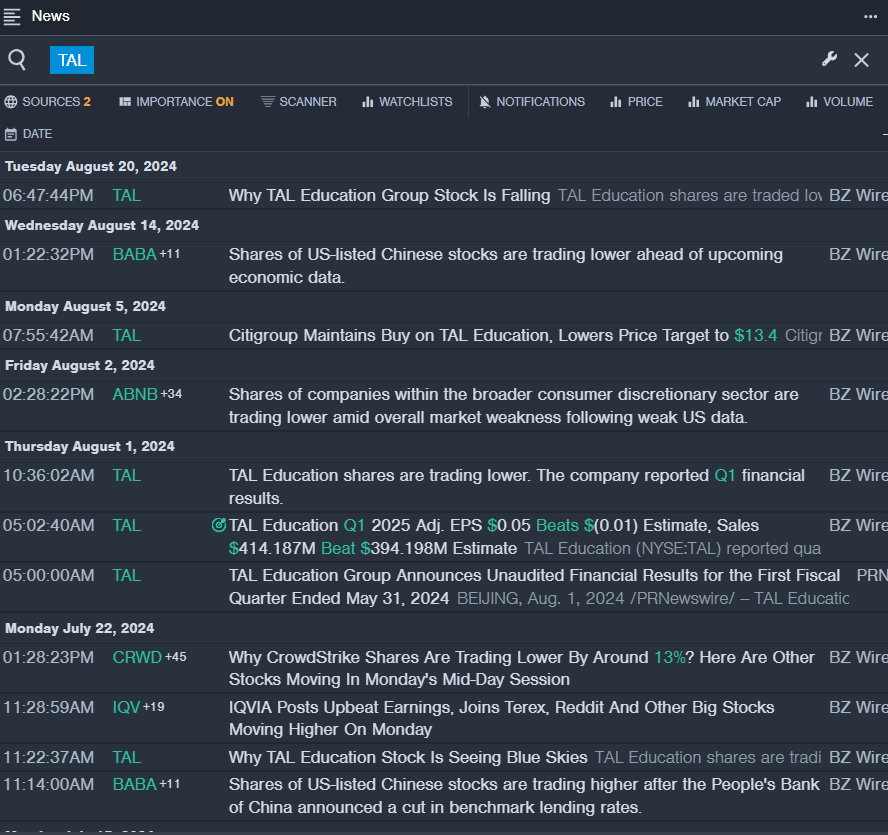

The Tale of TAL Education Group TAL

- Following an upbeat quarterly performance on Aug. 1, TAL Education Group is navigating the turbulent waters of the market with finesse. Alex Peng, TAL’s President and Chief Financial Officer, emphasized the importance of quality products and operational efficiency in serving learners effectively. Despite a recent 18% dip in stock price, TAL Education boasts a 52-week low of $6.81.

- RSI Value: 29.74

- TAL Price Action: Shares of TAL Education closed at $7.42 on Monday, reflecting a minor 0.1% decline.

The Resilience of Gaotu Techedu Inc GOTU

- On Aug. 27, Gaotu Techedu faced a wider-than-anticipated quarterly loss, sending ripples across the investment landscape. However, Larry Xiangdong Chen, the Company’s founder, Chairman, and CEO, highlighted positive indicators, including a 43.6% year-over-year increase in net revenues. Despite a 39% drop in stock price over the past month, Gaotu Techedu holds firm with a 52-week low of $2.22.

- RSI Value: 27.21

- GOTU Price Action: Gaotu Techedu shares ended Monday at $2.67, marking a slight 0.7% descent.

The Odyssey of Gogoro Inc GGR

- On Aug. 27, the tech voyage of Gogoro and Nebula Energy set course with the commercial availability of battery swapping and Smartscooters in the Kathmandu Valley. Despite a recent 36% decrease in stock price, Gogoro Inc remains optimistic, holding a 52-week low of $0.84.

- RSI Value: 21.96

- GGR Price Action: Gogoro shares closed at $0.86 on Monday, witnessing a noticeable 14.1% fall.

Diving into the tumultuous seas of the consumer market reveals hidden gems waiting to be discovered by those with a keen eye for opportunity.

As each stock charts its own unique course through the market’s turbulence, the astute investor may find solace in the resilience and potential growth that lies within these oversold stocks.