A Golden Opportunity Amidst Overbought Stocks

Investors, like prospectors panning for gold in a river, often search for precious opportunities amidst the market’s tumultuous waters. The financial sector currently presents a glittering chance to unearth undervalued gems that could potentially see a spark in the coming quarter.

An Insight into Oversold Stocks

The Relative Strength Index (RSI), a momentum indicator, provides traders with a valuable tool. It compares a stock’s strength on up days versus down days, offering a glimpse into its short-term performance potential. When the RSI dips below the 30 mark, indicating oversold territory, it may signify a buying opportunity for astute investors.

Exploring the Promising Trio

Apollo Commercial Real Estate Finance Inc (ARI)

- Despite a 13% dip in the past month and hitting a 52-week low at $8.76, Apollo Commercial Real Estate Finance Inc shows promising signs with an RSI value of 25.60.

- Recent earnings report revealed a positive upswing, and the stock closed at $8.89 most recently.

- Analyzed by Benzinga Pro, insightful newsfeed alerts reveal intriguing developments in ARI.

Ready Capital Corp (RC)

- Piper Sandler analyst, Crispin Love, maintained a Neutral stance on Ready Capital Corp while adjusting the price target, leading to a 7% stock drop in the last month, touching a 52-week low of $7.23.

- With an RSI value of 29.84, Ready Capital Corp exhibits a potential for an upswing, closing at $7.31 in the most recent trading session.

- Benzinga Pro’s charting tool enables investors to track and identify trends in RC stock effectively.

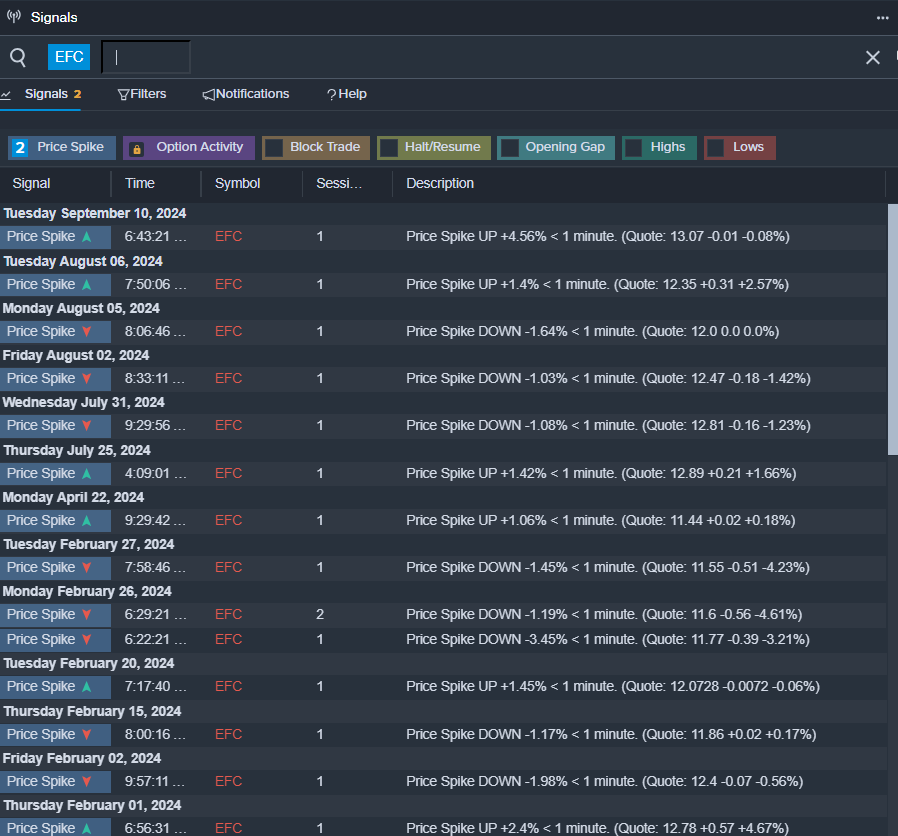

Ellington Financial Inc (EFC)

- Despite a 5% drop in the past month and touching a 52-week low of $10.88, Ellington Financial Inc exhibits signs of resilience with an RSI value of 29.38.

- After posting weaker-than-expected quarterly results, the company’s CEO, Laurence Penn, shared insights on revenue generation, and the stock closed at $12.46 recently.

- Highly perceptive signals from Benzinga Pro hint at a potential breakout in EFC shares, prompting investors to stay vigilant.

Read Next: Market News and Data brought to you by Benzinga APIs