Unlocking opportunities in the world of finance often means venturing where others fear to tread – into the realm of oversold stocks. This uncharted territory can offer investors a chance to stake their claim in undervalued companies.

When it comes to deciphering market jargon, the Relative Strength Index (RSI) emerges as a trusty navigator. This momentum indicator compares the stock’s strength on climbing versus falling days, shedding light on its short-term performance potential. An RSI below 30 typically signifies an oversold asset, beckoning savvy investors to take notice.

Let’s delve into the current roster of top contenders in the financial sector, poised for a turnaround as their RSIs hover near or below the coveted 30 mark.

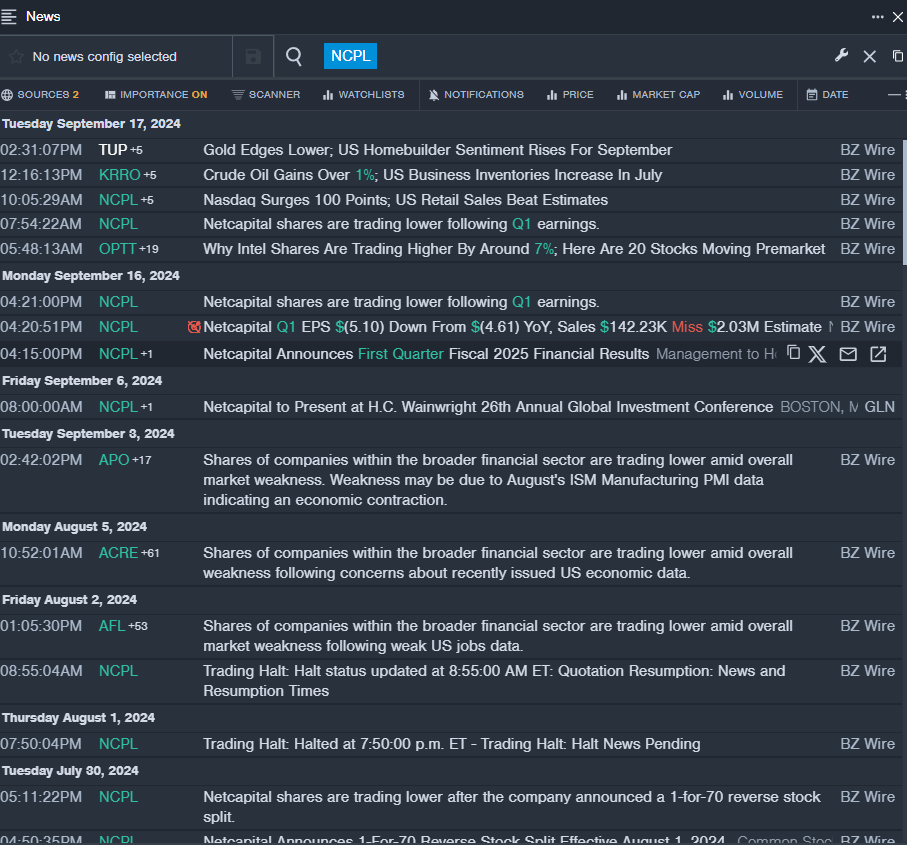

Netcapital Inc NCPL

- Recently, Netcapital Inc reported a first-quarter loss of $5.10 per share, attributing the challenging quarter to a dip in service revenues exchanged for equity securities. However, CEO Martin Kay remains optimistic, noting strategic groundwork being laid for future growth. The company’s stock plummeted by approximately 40% over the past five days, hitting a 52-week low of $1.54.

- RSI Value: 29.24

- NCPL Price Action: Netcapital’s shares dipped by 5.2%, closing at $1.63 on Thursday.

Reliance Global Group Inc RELI

- On September 9, Reliance Global Group provided an update on the pending acquisition of Spetner Associates, unveiling a significant reduction in the upfront cash payment required for the deal. Despite this positive development, the company’s stock witnessed an 11% decline over the past week, touching a 52-week low of $2.12.

- RSI Value: 27.09

- RELI Price Action: Reliance Global’s shares fell by 5.8%, settling at $2.45 on Thursday.

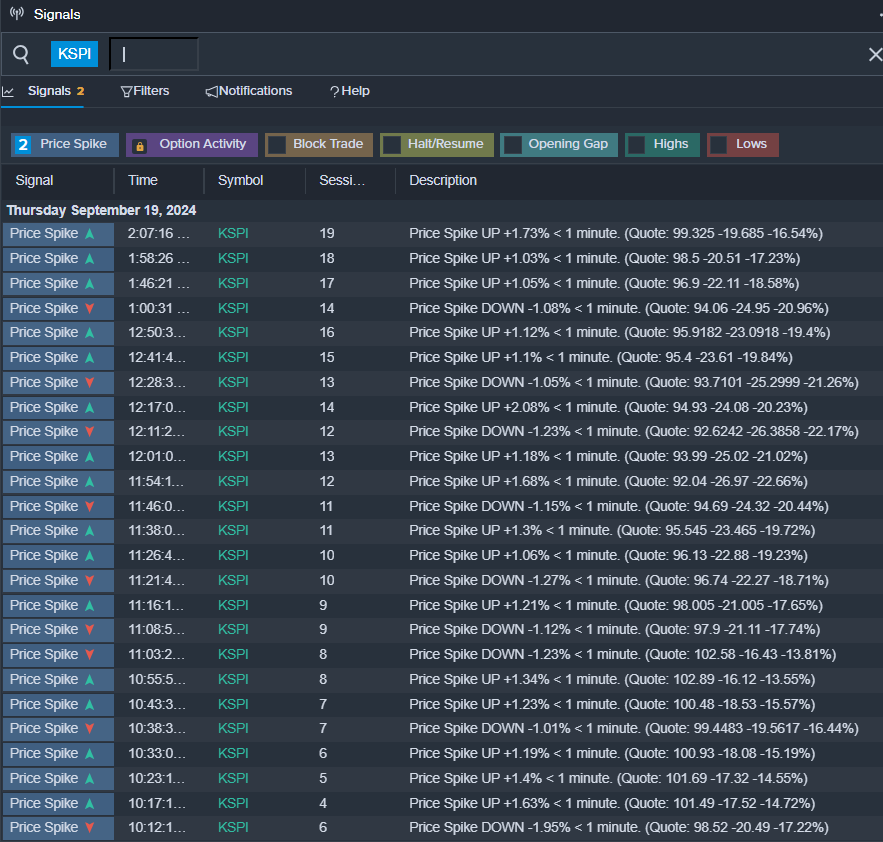

Kaspi.kz AO – ADR KSPI

- Market whispers on September 19 hinted at Culper Research’s evaluation of Kaspi.kz AO. The company’s shares nosedived by approximately 21% in the past week, hitting a 52-week low of $85.02.

- RSI Value: 18.65

- KSPI Price Action: Kaspi.kz AO’s stock plunged by 16.1%, closing at $99.81 on Thursday.

Unveil hidden potential and opportunities for growth in the financial market, ripe for the taking.

Market News and Data brought to you by Benzinga APIs