The health care sector offers a tantalizing landscape for investors seeking undervalued gems after witnessing a recent wave of oversold stocks.

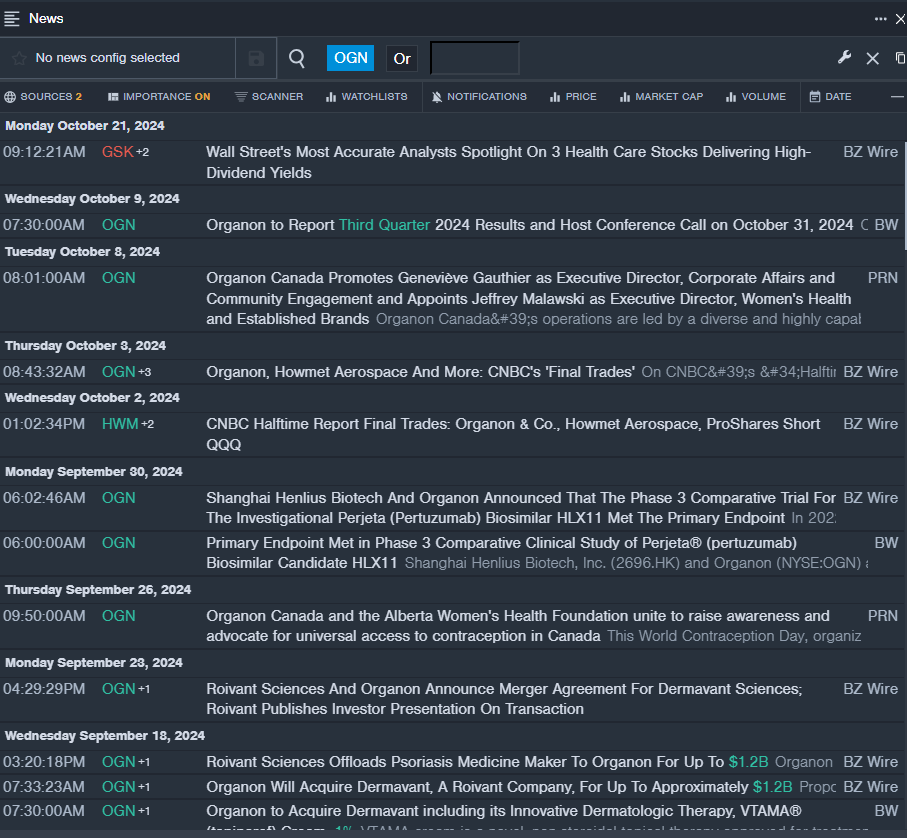

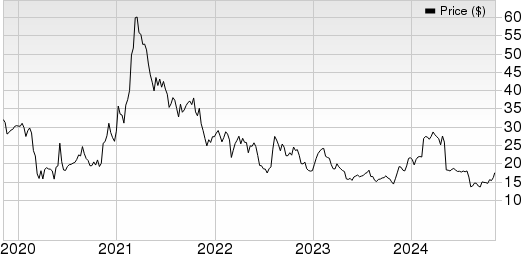

A Glimpse at Organon & Co

- Organon & Co is scheduled to unveil its third-quarter 2024 financial results on Oct. 31, setting the stage for potential market moves. Despite enduring a 12% decline in its stock value over the past month, the company’s shares remain intriguingly low, with a 52-week bottom at $10.84.

- Relative Strength Index (RSI): 28.28

- Stock Performance: Organon & Co witnessed a marginal 0.9% drop, closing at $17.45 on Monday, reflecting the company’s ongoing market narrative.

Exploring Arcutis Biotherapeutics Inc

- Arcutis Biotherapeutics Inc recently marked a significant milestone with Health Canada granting approval for ZORYVE® Foam to address seborrheic dermatitis among individuals aged 9 years and above. Dr. Melinda Gooderham, a leading medical expert, highlighted the therapy’s efficacy, with nearly 80% of patients achieving treatment success within 8 weeks. Despite a recent 14% dip in its stock value over five days, the company boasts a 52-week low of $1.76.

- Relative Strength Index (RSI): 28.13

- Stock Performance: Arcutis Biotherapeutics Inc observed a 4.7% decline, closing at $8.31 on Monday, aligning with its broader market trend.

Insight into TransMedics Group Inc

- TransMedics Group Inc is gearing up to announce its third-quarter financial results post-market closure on Monday, Oct. 28. The company’s shares have grappled with a 22% slump over the preceding month, showcasing resilience with a 52-week low of $36.42.

- Relative Strength Index (RSI): 29.60

- Stock Performance: TransMedics Group Inc experienced a mild 1.7% downturn, concluding at $124.48 on Monday, signaling ongoing market dynamics.