Seizing Opportunity Amidst Oversold Conditions

Investors often seek out oversold stocks as hidden gems, ready to shine once again.

One key metric used to identify oversold conditions is the Relative Strength Index (RSI), offering insights into potential short-term performance.

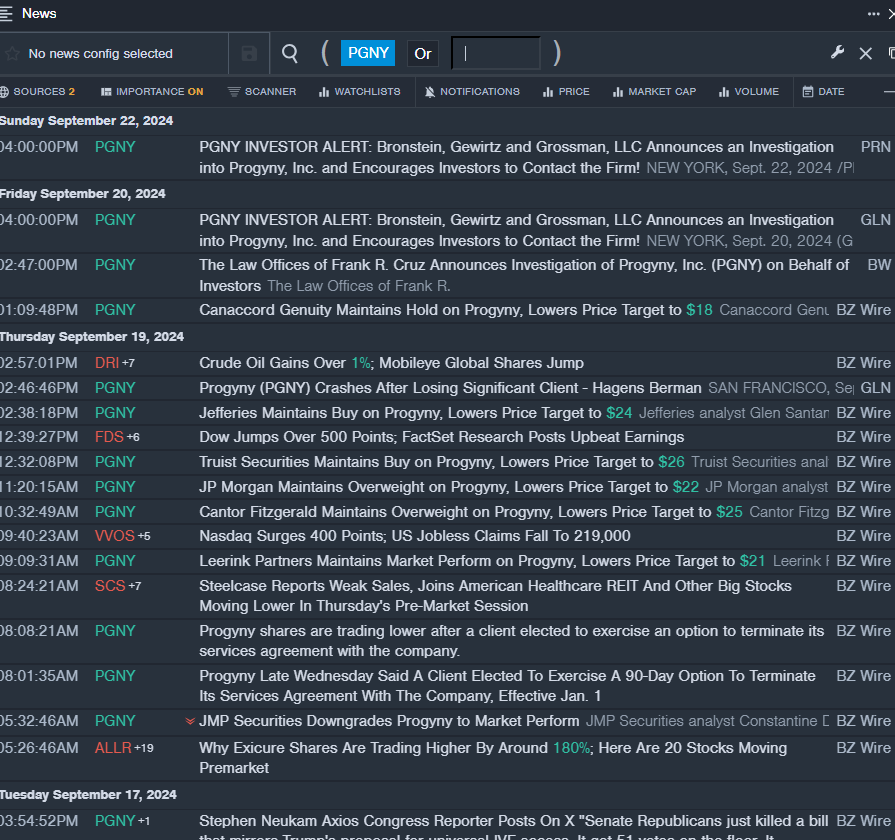

Progyny Inc: Weathering Storms with Resolve

- Despite recent challenges, Progyny Inc stands firm. A client’s decision led to a stock dip, but resilience is evident.

- RSI Value: 26.50

- PGNY Price Action: Progyny shares show subtle growth, a sign of underlying strength.

Indivior PLC: Navigating Rough Waters

- Indivior PLC faced headwinds following an update on a critical study. Yet, the company holds its ground with fortitude.

- RSI Value: 25.92

- RELI Price Action: Despite recent fluctuations, Indivior PLC’s stock remains resilient.

Moderna Inc: Charting a Path Forward

- Moderna Inc’s vaccine approval signifies progress despite recent market shifts.

- RSI Value: 28.17

- MRNA Price Action: Moderna’s shares display stability amidst uncertainty.

In times of market turbulence, these health care stocks stand as beacons of resilience.