When the tempest of uncertainty rages, some see a storm, while others seek a lifeline to safety. In the realm of the stock market, oversold health care stocks emerge as beacons, offering investors the chance to dive into undervalued enterprises.

One such lifeline lies in the Relative Strength Index (RSI), a compass guiding traders amidst the tumultuous seas. A reading below 30 on the RSI often signals an oversold asset, hinting at a potential for resurgence in the near term.

Let’s delve into the whirlpool of major oversold players in the health care sector, where opportunities beckon.

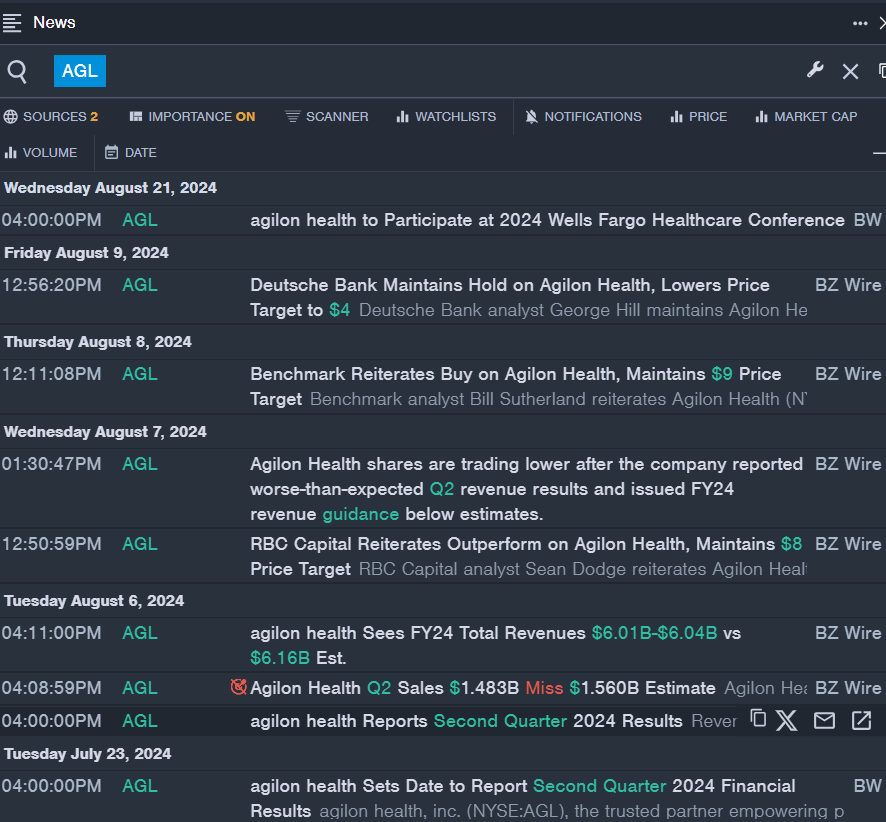

Agilon Health Inc (AGL)

- Agilon Health found itself in murky waters after reporting disappointing second-quarter revenue results, sending its stock plunging by 37% in the past month to touch a 52-week low of $4.38. Despite the storm, CEO Steve Sell affirmed the company’s full-year guidance.

- RSI Value: 27.10

- AGL Price Action: Agilon Health’s shares experienced a 2.2% decline, closing at $4.38 on Monday.

Verrica Pharmaceuticals Inc (VRCA)

- Verrica Pharmaceuticals shone a ray of hope with better-than-expected second-quarter financial results and promising findings from its Phase 2 trial. However, the stock tumbled by 64% in the past month, hitting a 52-week low of $2.53.

- RSI Value: 19.52

- VRCA Price Action: Verrica Pharmaceuticals’ shares closed 8.9% lower at $2.57 on Monday.

ALX Oncology Holdings Inc (ALXO)

- Despite ALX Oncology’s narrower-than-expected quarterly loss, the company witnessed a 56% decline in its shares over the past month, touching a 52-week low of $2.30. CEO Jason Lettmann expressed optimism about the firm’s pipeline.

- RSI Value: 28.48

- ALXO Price Action: ALX Oncology’s shares surged by 7.5%, closing at $2.57 on Monday.

Amidst the churning tides of the market, these health care stocks stand as lighthouses for investors, poised to navigate the storm and potentially guide portfolios to calmer waters.

So, as the market ebbs and flows, will these stocks shepherd your investments into a haven of profit? The answer lies in the winds of change and the resilience of these companies as they navigate through the currents of uncertainty.