Investors, brace yourselves for the potential hidden gems lurking within the industrials sector.

Painted with the brush of oversold conditions, these stocks beckon the shrewd. The Relative Strength Index (RSI) serves as a lodestar – a tool to decipher the cryptic movements of these equities. A stock’s strength oscillating on up versus down days unveils a tapestry that could foretell its fortune. Once RSI dips below 30, a twilight zone emerges, hinting at promise. But infer too much, one must not, for fortunes can be fickle in the stock market’s labyrinth of tides and undercurrents.

Let us delve into the recesses of this sector to unearth the three intriguing underdogs, teetering on the brink of redemption.

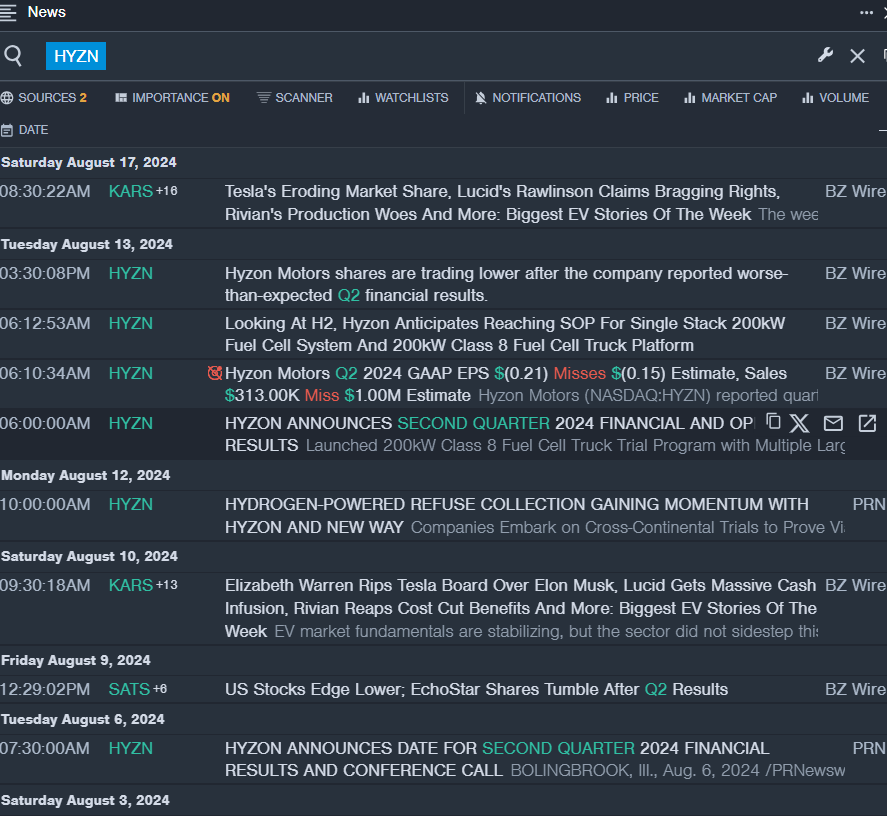

Hyzon Motors Inc HYZN

- Recent rumbles in Hyzon Motors’ Q2 earnings report sent seismic shivers through the market. The company’s pivot towards the North American Class 8 and refuse markets is a double-edged sword, poised for glory or downfall. The CEO’s words echo amid the tumult; a stock can indeed be a tempest in a teapot. Witness the 47% tumble down the price mountain over a mere quintet of days, as the 52-week low of $0.050 glimmers like fool’s gold in this turbulent landscape.

- RSI Value: 25.52

- HYZN Price Action: Friday’s $0.054 closing fee epitomizes a sharp descent, painting a picture of wounded pride and battered hopes.

Velo3D Inc VLD

- Velo3D’s crescendo in second-quarter adjusted EPS might seem like a siren’s song, but the subsequent freefall lends a note of caution. Amidst strategic acumen, the company navigates treacherous waters. The CEO’s melody narrates a tale of resilience and adaptability, as the stock charts a tumultuous 46% glide over a mere working week. The 52-week low at $1.23 casts a long shadow, accentuating the price’s downward spiral.

- RSI Value: 23.62

- VLD Price Action: Friday’s $1.23 denouement whispers a cautionary tale of volatility and fragility, a fragile equilibrium fraught with uncertainty.

Array Technologies Inc ARRY

- Array Technologies’ quarterly earnings acrobatics leave analysts flummoxed, an 81.82% beat that rings of prestidigitation. Yet, the cloak of uncertainty shrouds the company’s fiscal fortitude. Projections crumble beneath the weight of sobering reality, casting a pall over the market. The month-long 38% slide paints a canvas of doubt and hesitation, with the 52-week low at $6.43 looming large like the sword of Damocles.

- RSI Value: 23.63

- ARRY Price Action: Friday’s $6.55 closing chapter hints at a cautious optimism, a whisper amidst the cacophony of doubt and skepticism.

Indulge in deeper insights and revelations beyond the numbers.