Investing in Oversold Materials Stocks

The materials sector is experiencing a wave of opportunity as oversold stocks create a chance to invest in undervalued companies. By examining the Relative Strength Index (RSI), investors can gain insight into potential short-term performance of stocks in this sector.

The Potential of Westlake Corp (WLK)

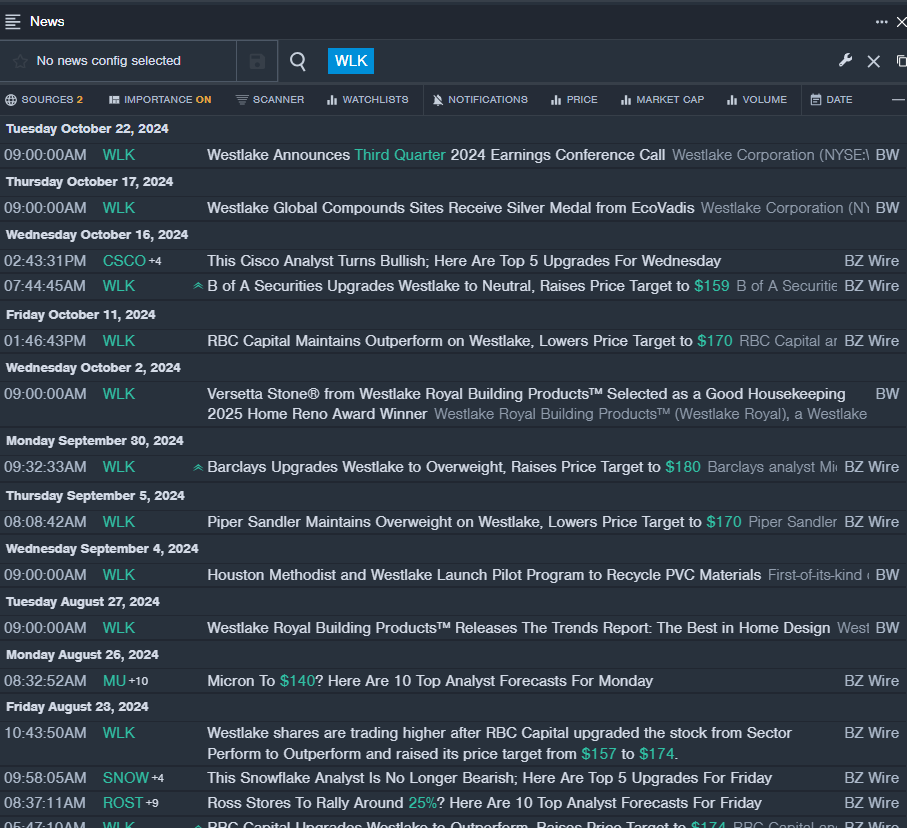

- Westlake Corp is set to release its third-quarter 2024 earnings, with analysts eagerly waiting for the results. The company’s stock has experienced a slight dip in the past month, presenting an RSI value of 27.60, signifying an oversold status in the market.

- Shares of Westlake closed at $134.79 on Thursday, reflecting a slight decrease, potentially aligning with the oversold status indicated by the RSI value.

By identifying these trends, investors can position themselves strategically in the market, anticipating a potential upswing as the company prepares to unveil its quarterly earnings.

Insights into Newmont Corporation (NEM)

- Newmont Corporation recently reported strong quarterly earnings, surpassing market expectations. Despite this positive news, the company’s stock experienced a significant decline in the past five days, with an RSI value of 20.36, indicating an oversold position in the market.

- With shares closing at $49.25 on Wednesday, investors may find an opportunity to capitalize on the current situation, potentially anticipating a reversal in the stock’s performance.

As investors navigate the market fluctuations, understanding the dynamics of oversold stocks like Newmont Corporation provides a strategic advantage in making informed investment decisions.

Exploring Olin Corp (OLN) Amidst Challenges

- Olin Corp recently released its third-quarter financial results, highlighting the impact of external factors such as Hurricane Beryl on its operations. Despite facing challenges, including operational limitations post-hurricane, the company continues to persevere in the market.

- The stock price of Olin Corp experienced a minor decline in the past five days, with an RSI value of 27.97, suggesting an oversold status. Investors monitoring this situation closely may detect opportunities for a potential market upturn in the coming days.

As Olin Corp navigates through difficulties, investors can observe its resilience in the face of adversity, potentially uncovering hidden opportunities amidst market challenges.

Conclusion

Investors exploring the materials sector have a unique opportunity to delve into oversold stocks, unveiling potential gems in undervalued companies. By leveraging indicators like the RSI and monitoring stock performance, astute investors can position themselves strategically in the market, ready to seize opportunities presented by market dynamics.