The Untapped Well of Undervalued Stocks

Within the vast sea of the communication services sector lie hidden treasures, overlooked by many but ripe for the taking by discerning investors. These stocks, having weathered recent storms, now show signs of resilience in the face of market turmoil. Let’s dive into the depths and uncover the top three tech and telecom equities poised to offer a lifeline to portfolios seeking growth.

A Glimpse Into the Oversold Realm

At the heart of the matter lies the Relative Strength Index (RSI), a compass guiding traders through the choppy waters of short-term stock performance. When this indicator dips below 30, a stock is deemed oversold, signaling a potential buying opportunity. As we navigate this data-driven landscape, a trio of companies stands out for their attractive valuations and strategic positioning.

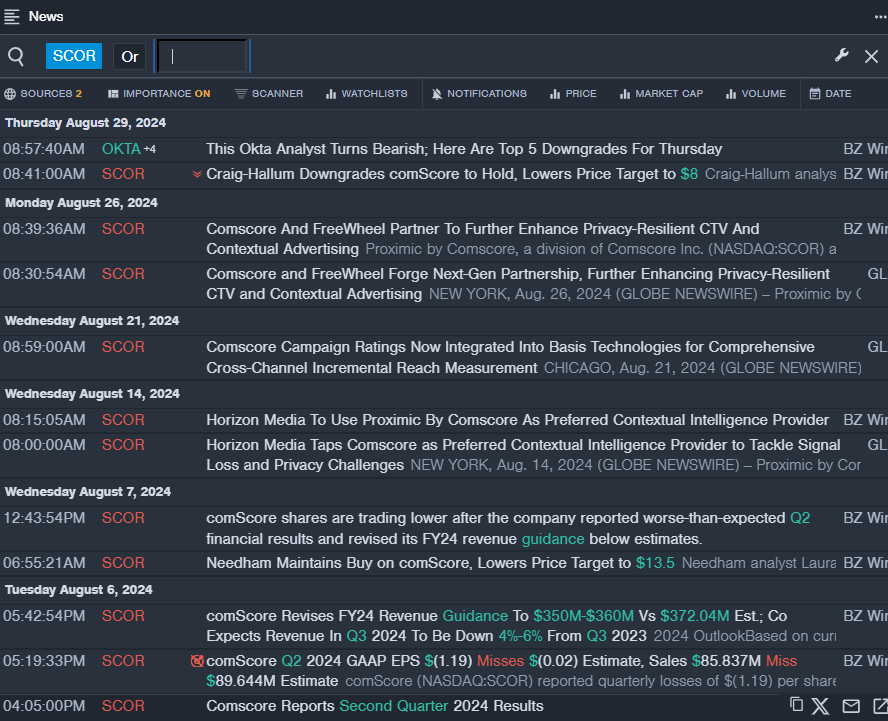

comScore Inc – SCOR

- comScore Inc recently faced headwinds as it reported disappointing second-quarter financial results and adjusted its revenue forecast below expectations. Despite this setback, CEO Jon Carpenter expressed confidence in the company’s trajectory towards providing omnichannel measurement solutions. With an RSI value of 28.03, comScore’s stock has seen a significant decline, presenting a compelling entry point for investors eyeing long-term growth.

- RSI Value: 28.03

- SCOR Price Action: The stock closed at $7.17, reflecting a modest 2.3% gain on Friday.

SPAR Group Inc – SGRP

- SPAR Group Inc, in contrast, weathered the storm with better-than-expected quarterly sales, fueled by a strategic focus on growth in the Americas. President and CEO Mike Matacunas highlighted the company’s robust financial position and increased demand for its services. Despite a recent 20% drop in stock price, SPAR Group remains resilient, with an RSI value of 25.61.

- RSI Value: 25.61

- SGRP Price Action: Closing at $1.45, SPAR Group demonstrates steady progress amidst market fluctuations.

IQIYI Inc – IQ

- Amidst analyst downgrades and a challenging market environment, iQIYI Inc grappled with a 31% decline in its stock price over the past month. Goldman Sachs analyst Lincoln Kong’s move to lower the rating to Neutral underscored the company’s struggles. However, with an RSI value of 26.24, iQIYI Inc remains a resilient player in the tech and telecom sector, offering potential opportunities for savvy investors.

- RSI Value: 26.24

- IQ Price Action: Despite a 4% decline, iQIYI Inc closed at $2.15 on Friday, hinting at a possible turnaround in the offing.

Charting the Course Ahead

As investors navigate the turbulent waters of the market, these oversold gems offer a ray of hope amidst the uncertainty. Like skilled sailors setting sail in stormy weather, those who identify potential opportunities in undervalued stocks may find themselves riding the waves to prosperous shores. The key lies in a keen eye, a steady hand, and the patience to weather the storms as the market ebbs and flows.