In the realm of communication services, the most oversold stocks are akin to buried treasures, offering investors a chance to seize undervalued gems.

One gauge that aids traders in pinpointing oversold assets is the Relative Strength Index (RSI). By measuring a stock’s strength on up versus down days, the RSI forecasts potential short-term performance trends. A stock often earns the “oversold” label when its RSI falls below 30, per financial insights platform Benzinga Pro.

Let’s delve into the current roster of prominently oversold players in this market, boasting an RSI hovering around or below the 30 mark.

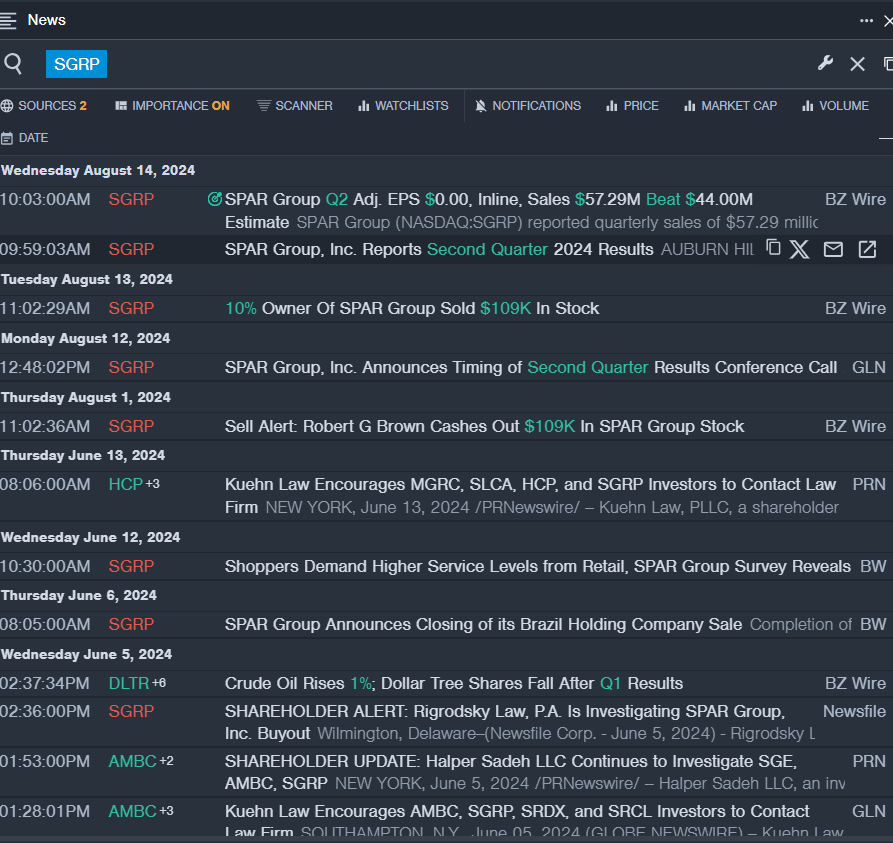

Revving Up with SPAR Group Inc (SGRP)

- SPAR Group Inc recently unveiled quarterly earnings that were in line with expectations. Mike Matacunas, the Company’s President and Chief Executive Officer, lauded the second quarter’s performance, emphasizing growth strategies in the Americas, particularly in the U.S. and Canada. The company noted a robust 37% revenue surge in the ongoing U.S. operations and a 14% uptick in Canada. Despite this, its stock witnessed a downturn of about 20% over the past month, hitting a 52-week low of $0.70.

- RSI Value: 29.68

- SGRP Price Action: SPAR Group shares encountered a 4.7% decline, settling at $1.63 on the most recent trading day.

Strike a Chord with Tencent Music Entertainment Group – ADR (TME)

- Tencent Music Entertainment revealed a 1.7% year-over-year dip in revenue for the fiscal second quarter of 2024, amounting to $985.00 million (7.16 billion Chinese yuan), missing the analyst consensus estimate of $996.68 million. Cussion Pang, Executive Chairman of TME, expressed satisfaction with the quarterly results, driven by stellar performances in the online music services sphere. Despite adding over 10 million net subscribers in the first half of 2024 and enhancing ARPPU figures, the company’s stock plummeted approximately 30% in the past month, with a 52-week low of $5.96.

- RSI Value: 28.08

- TME Price Action: Tencent Music shares managed a 0.6% uptrend, closing at $10.44 during the latest trading session.

Accelerating with Motorsport Games Inc (MSGM)

- Motorsport Games Inc exceeded expectations in its second-quarter financial report. Stephen Hood, President and Chief Executive Officer, lauded the results, particularly praising the success following the launch of Le Mans Ultimate in February 2024. Despite this positive news, the company faced a significant slump of around 51% in its shares over the past month, touching a 52-week low of $1.01.

- RSI Value: 28.84

- MSGM Price Action: Motorsport Games shares experienced a 0.9% surge, closing at $1.09 in the most recent trading session.

Discovering lucrative investments can be akin to deciphering a treasure map—requiring patience, strategy, and a keen eye for hidden value.