Anticipating Tesla’s Q3 Earnings

Tesla is on the brink of unleashing its third-quarter earnings report, scheduled to emerge post-market on Wednesday. The financial heartbeat predicts earnings to prance around 58 cents per share with revenues pirouetting at $25.6 billion. The earnings forecast, however, whispers of a 12.12% dip from the previous year. Nevertheless, yearly revenue might see a 9.5% growth spurt.

Delving into the historical treasure chest, Tesla has consistently missed EPS estimates for the last four quarters, with an average negative earnings surprise of 8%. A rollercoaster of expectations, indeed!

Unveiling Tesla’s Q3 Whispers

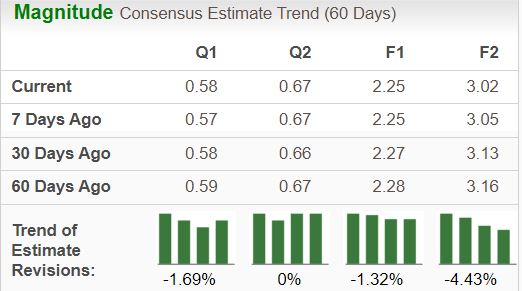

Whispers in the earnings corridors don’t bode well for Tesla. The oracle rings true, spoiling the earnings ESP with a -1.28% wrinkle. The Zacks Rank #2 may bring some solace, but in this instance, the crystal ball remains murky. Fortune-telling is best left to the divine, it seems.

Factors Painting TSLA’s Q3 Canvas

The third quarter saw Tesla produce an armada of nearly 469,796 vehicles, including over 443,668 Model 3/Y units. The delivery wagon orchestrated a spectacle, celebrating a 4.3% rise since the prior quarter. Despite the shortfall in vehicle tango, there was a year-over-year dance of joy.

Tesla’s automotive segment revealed plans for an exhilarating revenue sprint, expected to hit $22.2 billion. However, the quest for higher sales may have forced the margins to dance the limbo. Navigating the balance beam of demand and profit margin, Tesla wields both carrot and stick.

On the flip side, Tesla’s energy generation and storage business is tapping into potent opportunities. The revenue pipeline forecasts a bullish run at $2.16 billion, a crescendo to the tune of 39% yearly. One might wonder if the energy segment is Tesla’s lifeboat in this turbulent sea of transformation.

Tesla’s Stock Performance & Valuation Odyssey

If we peer through the looking glass of the year, Tesla’s stock journey reveals a modest 11% dip, a tale of resilience amidst the market’s symphony. Nevertheless, the specter of overvaluation casts a pall, standing in the limelight with a forward sales multiple of 6.38.

Decoding TSLA Pre-Q3 Earnings Playbook

As the theatrical curtains rise for the Q3 earnings saga, Tesla faces an ensemble of challenges. Despite the Robotaxi stumble, Tesla’s technological prowess shines, marked by the Optimus project and FSD Beta software rollout. Musk’s orchestra may have hit a few off-notes, but the promise of affordable EV models swirls on the horizon.

The cautious may heed the bell toll following the Robotaxi event, yet Ark Invest entwines a silver lining with a $3 million Tesla bet. The story unfolds, from the Robotaxi veil to the Ark Invest boon, revealing Tesla’s enduring journey in the stock market’s grand theater.

The Semiconductor Market: Trends and Opportunities

Unlocking the Potential of Semiconductor Stocks

Imagine a hidden gem in the vast domain of the stock market – a semiconductor stock quietly growing, ready to make a splash. While its size may just be a fraction of a giant like NVIDIA, this under-the-radar player offers immense growth prospects. NVIDIA, with its remarkable +800% surge, is undeniably robust, but the spotlight is now on a novel chip stock primed for a breakthrough.

Boasting robust earnings growth and a burgeoning clientele, this stock stands at the forefront of satisfying the insatiable hunger for advancements in Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor industry is poised to witness a meteoric rise, with projections soaring from $452 billion in 2021 to an astounding $803 billion by 2028.

Exploring the Market Dynamics

Amidst the hustle and bustle of the financial realm, the semiconductor sector stands out as a beacon of promise. Investors are avidly eyeing this flourishing industry as it fuels innovation across various technological domains. The demand for cutting-edge semiconductor solutions resonates across sectors, driving companies to innovate, adapt, and thrive.

Stepping into the semiconductor market unveils a realm bustling with potential. The interplay of demand, innovation, and expansion paints a vibrant landscape for investors seeking avenues for growth. With the horizon beckoning towards technological advancements, the semiconductor realm emerges as a fertile ground for those keen on strategic investments.

The Road Ahead: Navigating Investment Options

As the financial arena clamors for insights and opportunities, astute investors are drawn to the magnetic allure of semiconductor stocks. Despite the forthcoming results that may sway the market sentiment, this juncture presents a prime buying opportunity. The market dynamics pulsate with anticipation, offering a canvas of possibilities awaiting the strokes of shrewd investors.

Dare to delve into the realm of semiconductors – where each stock represents a unique narrative of growth, resilience, and innovation. Embrace uncertainty as a stepping stone towards exponential growth, and unveil the hidden potential of an industry ripe with opportunities. The forthcoming period holds promises and perils – a delicate dance that seasoned investors navigate with precision and insight.