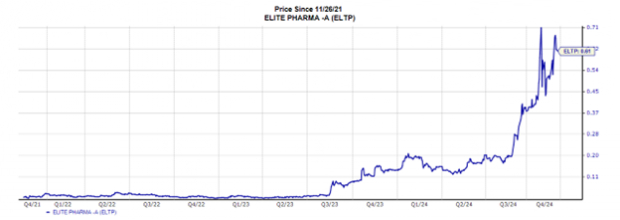

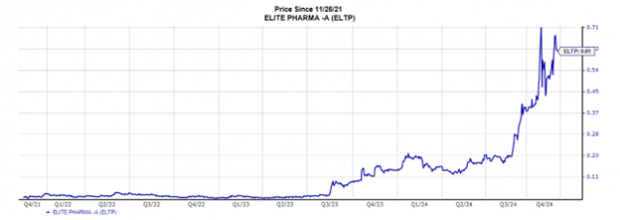

Elite Pharmaceuticals Inc. (ELTP) fits nicely into the nexus of the increasing diagnoses of ADHD and the patent expiration of the branded drug Vyanse in 2023 for its treatment. Elite Pharmaceuticals Inc. recently received FDA approval for its generic version of Vyanse and expects to launch the product in early 2025.

Image Source: Zacks Investment Research

Adults as well as women and girls are increasingly being diagnosed with ADHD globally as the medical community continues to understand the symptoms calculus along the neurodivergent spectrum. And medications have proven highly effective in treating ADHD. Recent press coverage on this topic is noteworthy. Also noteworthy are the supply challenges facing ADHD drug producers and the recent raising of production quotas by the DEA. The company has publicly stated that it estimates that it has a greater than 10% share of the Adderall market. The bet here is that the company can duplicate this growth success with its generic version of Vynase. Elite Pharmaceuticals (ELTP) reported revenues of $18.9 million for the three months ended Sept. 30, 2024, marking a 33.4% year-over-year increase. This robust growth was primarily driven by the Elite label product line. For the six months, revenues reached $37.7 million, a 62.9% rise from the previous year. The stock is currently trading at 6.2X trailing 12-month EV/Sales TTM, which compares to 2.9X for the Zacks sub-industry, 3.8X for the Zacks sector and 5.4X for the S&P 500 Index. Over the past five years, the stock has traded as high as 7.4X and as low as 0.7X, with a five-year median of 2.2X. The main risk factor is the successful execution and timing of bringing pipeline products to market. The second company, Precipio Inc (PRPO), despite being only an $8.8 m market cap, is also worthy of attention. Precipio is a molecular diagnostics company. I have had good success in this space in the past, e.g. Clarient and Neogenomics (NEO) so I’m going to the well again.

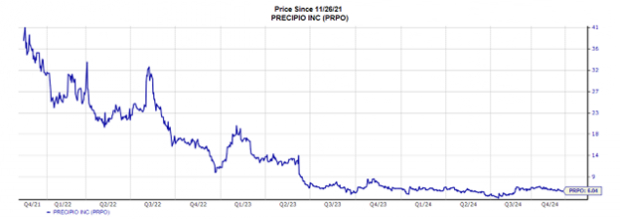

Image Source: Zacks Investment Research

The company’s products are focused on blood cancers and compete in the market based on the relative precision and accuracy of its tests. Cancer misdiagnosis by current diagnostic tests in the marketplace is a growing problem. These diagnostic or informational tests are not heavily regulated and can be scaled quickly with compelling unit economics. And they typically fetch attractive sales multiples. Precipio Inc. (PRPO) is presently trading at only .5x TTM sales. Importantly, the company expects to be break-even by the end of 2024 without the need for capital raises, a rarity in this industry. Additionally, it has relatively small Medicare exposure. Total revenue increased 15% YOY in Q3 to $5.2 m with lab services growing 23% YOY and comprising the majority of revenue at $4.5 m. The company expects its smaller and higher margin product revenue segment to become the main growth generator going forward. The company is in the process of on-boarding 3 new customers for this segment via the distribution channel vs direct sales which is expected to open up market access opportunities. The bet is that the company can continue its pace of topline growth with enhanced profitability resulting in multiple expansion. The stock is currently trading at 0.5X trailing 12-month EV/Sales TTM, which compares to 1.7X for the Zacks sub-industry, 3.9X for the Zacks sector and 5.3X for the S&P 500 Index. Over the past five years, the stock has traded as high as 25.7X and as low as 0.3X, with a five-year median of 2X. The stock is currently trading at 0.8X trailing 12-month P/B TTM, which compares to 3.7X for the Zacks sub-industry, 4.9X for the Zacks sector and 8.6X for the S&P 500 Index. Over the past five years, the stock has traded as high as 8.1X and as low as 0.4X, with a five-year median of 1.1X. Customer concentration is a risk factor with one customer representing 14% of 2024 9-month sales.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Elite Pharmaceuticals Inc. (ELTP): Free Stock Analysis Report

Precipio, Inc. (PRPO) : Free Stock Analysis Report