Artificial intelligence (AI) stocks have been a hot topic on Wall Street for quite some time now, and one clear winner has been AI chip giant Nvidia (NVDA). Shares of NVDA have generated a mouthwatering 19,437% return over the last decade. Beyond Nvidia, another handful of AI winners are emerging as the technology gains wider adoption – like new S&P 500 Index ($SPX) component Super Micro Computer (SMCI), now up by 6,463% over the past 10 years.

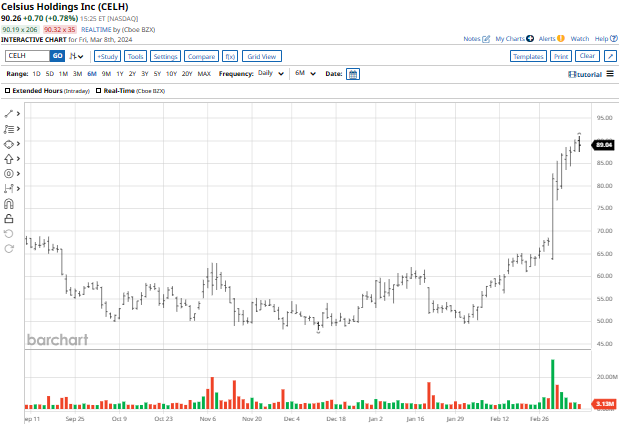

But while the massive share price gains racked up by AI stocks like Nvidia and Super Micro Computer have been garnering all the headlines, there is one under-the-radar stock that has outperformed both of these two over the past decade. Celsius Holdings (CELH), a maker of energy drinks, has vaulted from penny stock territory in this same time frame to its current perch around $88 per share, posting a 10-year return of 31,646% in the process. Here’s how much more upside Wall Street is expecting.

The Rise of Celsius Holdings

Celsius Holdings (CELH) is a manufacturer and distributor of functional beverages, foods, and other supplements. Marketing under the Celsius and FAST brands, they provide their customers with calorie-burning beverages, liquid supplements, protein bars, sports drinks, and more. Headquartered in Boca Raton, the company operates in the U.S., Canada, Asia-Pacific, Europe, and the Middle East.

CELH stock has rocketed 63% YTD, and is trading near its all-time highs.

Despite its outperformance, one reason stocks like Celsius Holdings might fly under the radar is because of its smaller market cap. Whereas Nvidia now lags only Microsoft (MSFT) and Apple (AAPL) in size, Celsius has a market cap of only $20 billion – less than one-third the current size of its former S&P MidCap 400 ($IDX) peer, Super Micro.

Celsius Holdings reported stellar results in its Q4 report, where it posted strong EBITDA of $65 million. That comfortably beat analysts’ estimates of $60 million, driven by improved gross margins and revenue growth. Gross profit was up 110% to $166 million, and gross profit as a percentage of revenue also improved to 47.8%, led by better efficiency in waste management, raw material sourcing, and improved leverage from promotional allowances.

Earnings per share came in at $0.17, or $0.15 on an adjusted basis. Organic sales improved by 95% to $347 million, which topped analysts’ consensus estimates. For the full fiscal year, revenue more than doubled to $1.32 billion.

Should You Invest in Celsius Stock?

Analysts are optimistic about Celsius Holdings, as they have a consensus “Strong Buy” rating with a mean price target of $91.61, reflecting about 3% potential upside. However, B. Riley just raised its price target for the stock to a new Street-high of $110, signifying a potential return of about 23.7% from current levels.

Out of 14 analysts currently tracking the stock, 12 have a “Strong Buy” rating and 2 have a “Hold” rating on CELH.