Verizon Communications Inc. VZ has recently unveiled an enticing offer to customers – a complimentary subscription to Netflix Inc.‘s NFLX premium plan for a year with the purchase of a one-year exclusive premium streaming service for National Football League. This strategic move under the “myPlan” program aims to allure customers with potential savings of $276 annually.

The bundled package includes exclusive live games during the 2024-2025 NFL season, NFL Network access for football news, and engaging Netflix content.

The Double-Edged Sword of Promotions

Though the offer is expected to expand Verizon’s customer base, the generous discounts may exert pressure on profit margins. Furthermore, the company faces challenges in its wireline division due to losses in access lines from VoIP providers and fierce competition in triple-play services.

Verizon has made substantial investments in building its 5G Ultra Wideband network and acquiring mid-band spectrum in the C-Band auction. However, high expenses from these endeavors could impact margins significantly.

Market Dynamics and Company Challenges

Verizon saw 65,000 Fios Video net losses in Q2 2024, illustrating the shift toward over-the-top offerings from traditional linear video. In a saturated U.S. telecom market, Verizon competes with AT&T Inc. and T-Mobile US Inc. Despite a 22.5% stock gain over the past year, it lags behind industry growth.

The telecom industry faces a spectrum crunch, grappling with the surge in mobile data traffic driven by smartphone usage, online video streaming, and cloud services.

Positive Momentum for Verizon

Although the discounted plans may strain margins, Verizon’s mix-and-match pricing strategies have led to strong customer additions. The company’s focus on 5G adoption, cloud services, and professional solutions is driving growth.

Verizon’s expansion of 5G networks and innovative services like On Site 5G for enterprises offer promising revenue streams. The company’s advancements in 5G technology demonstrate its commitment to providing superior connectivity experiences.

Driving Innovation with Fiber Optics

With robust infrastructure and technology investments, Verizon continues to enhance its wireless networks with 4G and 5G capabilities. The company’s emphasis on fiber optics expansion supports wireless and wireline connections, catering to increasing data demands across various sectors.

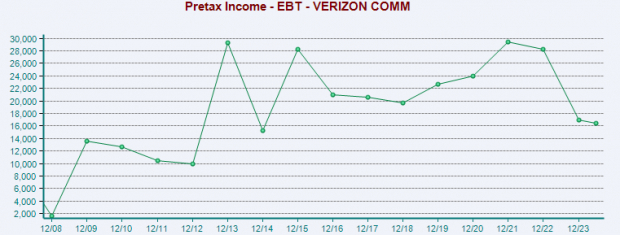

Financial Outlook and Investor Caution

Analysts have revised downward Verizon’s earnings estimates for 2024 and 2025, signaling bearish sentiment. Despite its infrastructure investments and technological advancements, Verizon operates in a competitive market, facing pricing pressures and profitability challenges.

Investors holding Verizon stock, ranked at #3 (Hold) by Zacks, should exercise caution in light of market dynamics and estimate trends.