Shares of Viking Therapeutics (VKTX) have witnessed a meteoric rise of almost 25% in the past month, propelled by positive developments in its investigational obesity and non-alcoholic steatohepatitis (NASH) candidates. The company’s ambitious plans involve moving these candidates to late-stage development by the dawn of 2025.

Recent revelations following the second-quarter earnings announcement included insights from the FDA on the trajectory of the obesity drug VK2735. Viking Therapeutics is now gearing up to propel VK2735 into phase III development for obesity. Preceding the study kick-off, a rendezvous with regulatory officials is slated before the year concludes to strategize the study design and schedule. An additional FDA sit-down during the fourth quarter aims to outline the late-stage study parameters for the NASH drug candidate VK2809.

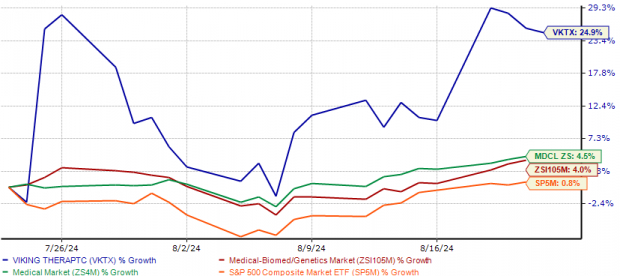

The resulting market upswing was the direct consequence of these pipeline advancements. Over the past month, the stock has outperformed industry growth by a striking 25%. Simultaneously, it has trumped both the sector average and the S&P 500, with shares trading above the 50-day and 200-day moving averages.

An Industry Star on the Rise

Image Source: Zacks Investment Research

Before delving deeper, scrutinizing the factors shaping the company’s future prospects is imperative.

Encouraging Progress in Obesity Drug Development

Over recent years, the obesity market has beckoned investor enthusiasm, spurred by the exceptional sales performance of obesity drugs Zepbound and Wegovy marketed by pharmaceutical behemoths Eli Lilly (LLY) and Novo Nordisk (NVO) respectively. Against this backdrop, both companies have witnessed a surge in investor interest.

Despite lacking any commercially marketed drugs, Viking Therapeutics stands out as a biopharma entity showcasing significant promise in the obesity domain, backed by the treatment potential of VK2735. Extensively assessed in clinical trials, this drug, administered as a subcutaneous injection and oral pill, has displayed remarkable weight reduction efficacy.

In a notable development, the VENTURE study, which evaluated the subcutaneous formulation of VK2735, achieved all primary and secondary endpoints with statistical significance. Patients who received the subcutaneous formulation recorded a mean weight reduction of 14.7% after 13 weeks in contrast to a mere 1.7% in the placebo cohort. Follow-up data from the early-stage evaluation on the oral formulation of the drug indicated promising dose-dependent reductions in mean body weight after 28 days of daily dosing.

Viking Therapeutics’ robust showing in the obesity space comes amid robust market growth projections. As per Goldman Sachs’ research, the obesity market in the United States is on track to hit a monumental $130 billion by 2030. These figures underscore the growing demand, evidenced by Lilly and Novo struggling to meet the market’s needs despite sizable profits from existing obesity sales. Anticipating this growth trajectory, both companies are intensively investing in bolstering production capacities and exploring novel obesity candidates.

Potential in NASH Drug Development

Viking Therapeutics recently concluded the VOYAGE study, evaluating VK2809 as a prospective treatment for patients with biopsy-proven NASH.

The study yielded promising findings, showcasing substantial histologic changes upon hepatic biopsy examination post 52-week VK2809 treatment versus a placebo. Noteworthy, 40-50% of VK2809 recipients achieved NASH resolution and at least one-stage improvement in fibrosis, significantly outpacing the placebo cohort’s 20% success rate. Earlier, patients treated with VK2809 attained a statistically significant reduction in liver fat content following 12 weeks of treatment, already meeting primary study endpoints.

Bolstered by these results, there is contemplation that the drug could challenge Madrigal Pharmaceuticals’ Rezdiffra (MDGL) in the NASH marketplace. Approved by the FDA in March 2024, Madrigal launched the drug commercially in April. Viking Therapeutics is currently seeking partnerships to advance and market VK2809.

Navigating Through Market Competition

While Viking Therapeutics has garnered praise for its promising pipeline output, the company traverses a competitive landscape in its target markets. Intensive competition awaits in the obesity realm, with industry heavyweights like Eli Lilly and Novo Nordisk vying for dominance either with existing marketed drugs or through their clinical candidates. Furthermore, leading pharma and biotech enterprises such as Roche, AstraZeneca, Pfizer, and Amgen are actively progressing their obesity portfolios, leveraging well-established distribution networks and supply chains.

Stock Evaluation & Projections

Viking Therapeutics currently trades at a premium compared to the industry benchmark. The stock registers a price/book ratio of 7.74, exceeding the industry’s 4.67 and a mean of 2.04 over the past twelve months.

Image Source: Zacks Investment Research

Loss per share estimations for 2024 have contracted from $1.08 to 99 cents over the preceding month, with 2025 estimates expanding from $1.42 to $1.48. Elevated research and development expenses to drive pipeline expansion account for the uptick in 2025 loss projections.

Image Source: Zacks Investment Research

Final Thoughts

While acknowledging Viking Therapeutics’ premium valuation relative to peers, the trajectory of the #3 Ranked ticker attests to growth opportunities beckoning investors. Both the obesity and NASH sectors exhibit robust growth potential. Supported by a $942 million cash reserve as of June 2024, Viking Therapeutics is well-equipped to fund operational activities, inclusive of late-stage pipeline endeavors. Given the track record of success in pipeline advancement, the company could attract acquisition interest from prominent pharmaceutical entities.

For existing shareholders, a plethora of catalysts including pipeline advancements, study data releases, and potential drug approvals offer avenues for share price fluctuations, a narrative that sustains investor interest in the stock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.