In the world of capacitors, Vishay Intertechnology VSH has made a bold move by introducing the Vishay Sprague TX3 series. These TANTAMOUNT surface-mount solid tantalum molded chip capacitors are designed to revamp electronic detonation systems.

With tantalum anode technology promising stable performance even in the harshest environments, these capacitors come with low direct current leakage values, setting a new standard in the industry.

Vishay is not merely dipping its toes into the mining and demolition waters; it’s diving right in. The Vishay Sprague TX3 series is expected to make waves across these applications, showcasing the company’s commitment to innovation and market penetration.

An ambitious move indeed, but one that could pay off handsomely. According to a report by Mordor Intelligence, the global capacitor market is set to swell to $25.21 billion by 2024 before reaching a staggering $33.57 billion by 2029, riding the wave of a robust CAGR of 5.9%.

Strength of the Portfolio: Fueling Growth

The introduction of the Vishay Sprague TX3 series is not an isolated event. It is part of a broader strategy aimed at fortifying Vishay’s product portfolio and cementing its position in the market.

Recent launches like the Gen 3 1200 V silicon carbide (SiC) Schottky diodes and the acquisition of Ametherm highlight Vishay’s multifaceted approach to expansion. These strategic moves aim to enhance efficiency and reliability in switching power designs, further broadening the company’s product offerings.

Vishay’s venture into the inductor domain with the Dale IHLE-4040DDEW-5A and the expansion of its resistor lineup with the Vishay Draloric AC05 series add layers to its growth story. These initiatives underscore the company’s ambition to tap into various end markets and drive customer engagement.

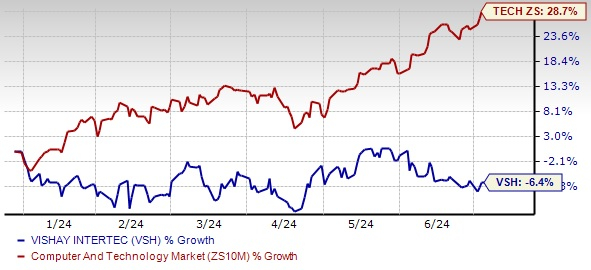

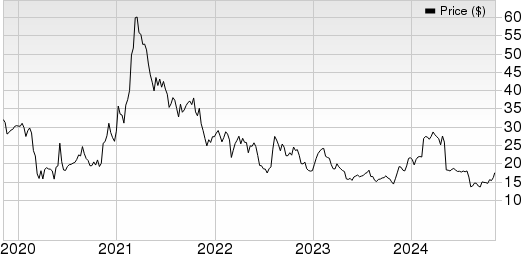

Yet, challenges loom on the horizon. Inventory adjustments, shrinking lead times, and a cooling demand landscape across industrial sectors pose significant hurdles for Vishay. As a result, the company has seen its shares dip by 6.4% year-to-date, a stark contrast to the Computer & Technology sector’s robust 28.7% growth.

Analysts’ projections for 2024 paint a cautious picture. Revenues are expected to decline by 10% year over year, with earnings taking an even harder hit, plummeting by 64.3%. The downward revision of 20.9% in the last 60 days reflects the uncertainties clouding Vishay’s near-term prospects.

Analyzing the Outlook and Recommendations

Despite these challenges, Vishay soldiers on with a Zacks Rank #3 (Hold). While the road ahead may be bumpy, there are brighter spots in the broader technology landscape.

Companies like Arista Networks, Garmin, and Apple, each boasting a Zacks Rank #2 (Buy), present compelling alternatives for investors seeking growth opportunities amidst turbulent market conditions.

Arista Networks has seen its shares soar by 42.1% year-to-date, with a promising long-term earnings growth rate of 16.07%. Garmin and Apple, with their respective gains of 26.6% and 20.1%, also offer favorable growth trajectories, sporting long-term earnings growth rates of 8.04% and 12.48%, respectively.