When faced with the decision to buy, sell, or hold a stock, investors often turn to the guidance of Wall Street analysts. These financial gurus wield significant influence over market sentiment through their brokerage recommendations, but are these opinions truly valuable?

Before delving into a discussion about the reliability of brokerage suggestions and how investors can leverage them to their advantage, let’s turn our attention to the current sentiment surrounding Alibaba (BABA) as expressed by these esteemed analysts.

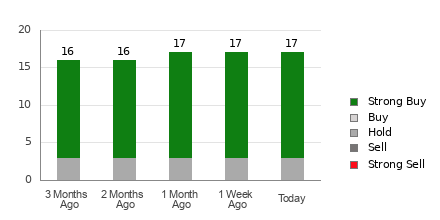

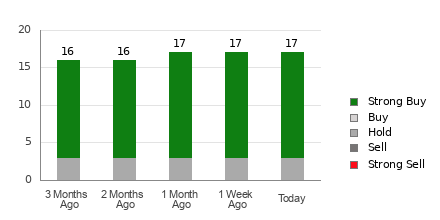

Alibaba presently boasts an average brokerage recommendation (ABR) of 1.35 on a scale from 1 to 5 (ranging from Strong Buy to Strong Sell), a figure derived from the specific recommendations (Buy, Hold, Sell, etc.) provided by 17 brokerage firms. An ABR of 1.35 hovers between Strong Buy and Buy ratings. Among the 17 recommendations contributing to the ABR, an overwhelming 14 stand as Strong Buy, accounting for a striking 82.4% of all the endorsements.

Brokerage Recommendation Trends for BABA

Though the ABR signals a suggestion to buy Alibaba, it’s prudent not to base investment decisions solely on this metric. Multiple studies have highlighted the limited success rate of brokerage recommendations in pinpointing stocks with the greatest potential for price appreciation.

Have you ever wondered why? Analysts associated with brokerage firms exhibit a notable bias towards positively rating the stocks they cover due to their vested interests. Research indicates that these analysts dole out five “Strong Buy” recommendations for every “Strong Sell” endorsement, underscoring how their allegiances may not align with those of the average retail investor, often failing to accurately predict a stock’s trajectory. Therefore, it is more beneficial to treat these recommendations as a validation tool for your independent research or a complementary factor when utilizing a proven indicator for forecasting stock price movements.

Our internally vetted stock assessment tool, the Zacks Rank, furnishes valuable insights into a stock’s short-term price outlook through its verifiable track record. Categorized into five distinct tiers ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this proprietary model serves as a dependable gauge for gauging investment potentials. Hence, cross-referencing the ABR with Zacks Rank data can significantly aid in steering you towards a sound investment decision.

Zacks Rank Should Not Be Confused With ABR

Despite both Zacks Rank and ABR being rated on a 1-5 scale, they pivot on disparate evaluations.

ABR solely hinges on broker endorsements and typically manifests in decimal ratings such as 1.28. Conversely, the Zacks Rank operates as a data-driven algorithm that heavily factors in earnings estimate revisions, displayed in whole numbers from 1 to 5.

Conventionally, brokerage analysts exhibit a propensity towards unwarranted optimism in their recommendations, likely driven by their employers’ interests, which may mislead investors more than guide them. In sharp contrast, the Zacks Rank leans on earnings forecast revisions, a metric significantly correlated with short-term stock price shifts as validated by empirical studies.

Moreover, the Zacks Rank uniformly applies its diverse rating spectrum across all stocks featuring earnings projections by brokerage analysts for the ongoing fiscal year, ensuring equitable representation within its rating bands. This consistency is a stark departure from the often skewed and dated nature of ABR assessments.

Thus, while ABR information may occasionally lag, the Zacks Rank promptly incorporates impending shifts in earnings estimates by brokerage analysts in its evaluations, ensuring timely and insightful projections on future stock performance.

Should You Invest in BABA?

Examining the recent earnings estimate revisions associated with Alibaba, the Zacks Consensus Estimate for the present year has remained static at $8.20 over the past month.

An unabated consensus view on Alibaba’s earnings potential, mirrored by the unaltered average estimate, might indicate a trajectory aligning with broader market movements in the immediate future.

Given the modest modifications in consensus estimates alongside other key factors governing earnings forecasts, Alibaba currently holds a Zacks Rank #3 (Hold) position. You can peruse the complete roster of Zacks Rank #1 (Strong Buy) stocks here >>>>

Therefore, prudence may be advised when contemplating an investment mirroring the Buy-equivalent ABR stance on Alibaba.

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report