Investors today face the Herculean task of securing a princely $1 million for their retirement, an amount that has withered in value due to the ravages of inflation. Nevertheless, it is a laudable objective, particularly when juxtaposed with the paltry $87,000 set aside for retirement by the typical American household. Achieving this financial milestone hinges on identifying exceptional companies, infusing capital into them, and patiently permitting substantial growth to accrue over the years.

Tesla – Pioneering Electric Vehicle Revolution

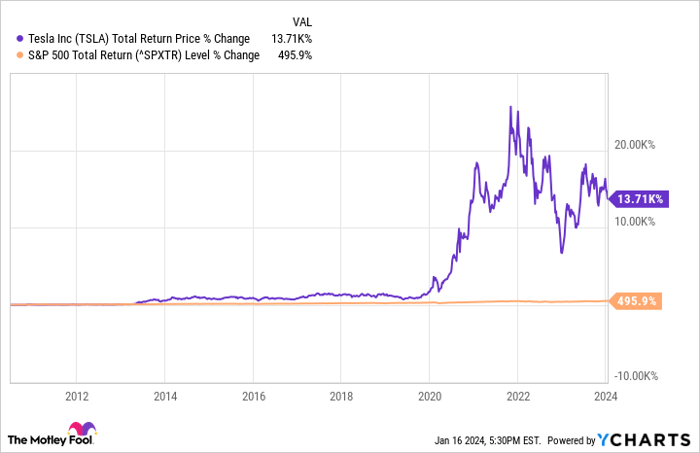

The electrification of the automotive industry has transitioned from a niche phenomenon to a sweeping tidal wave. This epochal transformation could eventually outrun conventional internal combustion engines to become the predominant vehicular technology. Tesla (NASDAQ: TSLA) has been an instrumental force in propelling this transition. Over the past decade, the company has richly rewarded its shareholders with transformative returns. It has weathered its share of difficulties, but today, Tesla stands as a profitable enterprise with annual sales amounting to over $95 billion.

Caterpillar – The Cornerstone of Construction

Construction, a ceaseless endeavor, calls for the perpetual shifting of immense quantities of rock and soil. Caterpillar (NYSE: CAT) has emerged as an extraordinary investment, consistently surpassing the broader market for years. The company’s distinctive yellow machinery is an omnipresent sight on construction sites, emblematic of its robust presence. It has evolved into a diversified entity, earning revenue via the sale, financing, and servicing of machinery.

Illinois Tool Works – A Master of Diversification

Achieving resilience against the economic volatility that often besets industrial companies hinges on diversification. Illinois Tool Works (NYSE: ITW) has mastered this art. The company comprises several smaller, highly profitable businesses in varied end markets such as automotive, food and beverage, materials, construction, testing, welding, and more. This mosaic of segments positions it to weather downturns. Illinois Tool Works has surged ahead to increase its dividend for 60 consecutive years while concurrently outpacing the S&P 500.

Albemarle – Riding the Lithium Wave

Lithium, a fundamental ingredient in battery manufacturing, augurs a radiant future for the fervent miner and refiner, Albemarle (NYSE: ALB). In addition to lithium, the company also processes other specialty materials.

Albemarle’s Stock Resilience Amid Economic Uncertainties

In the mercurial world of investments, a company’s stock can be battered by economic headwinds. For Albemarle, an enterprise amid turbulent waters, it’s a testament to their resilience. The company has maintained and increased its dividend for an impressive 29 consecutive years. This unconventional strength has set them apart as an industry standout, a rare gem sparkling against the tumultuous backdrop of economic uncertainty.

The Path to Long-Term Growth

Commodity markets are notorious for their capricious nature, subjecting investors to the peaks and valleys of stockholding. Despite these fluctuations, Albemarle exhibits a discernible trajectory toward long-term growth. The company is strategically developing mines across the globe to bolster its lithium production. With aspirations to triple capacity by 2030 to a staggering 650 KTPA (thousand tonnes per annum), Albemarle is diligently positioning itself to harness the anticipated multidecade shift to electric vehicles. As the world hurtles towards an electric future, Albemarle’s sound business acumen ensures it remains a stalwart fixture for years to come.

Investor Insights

The capricious nature of the investment landscape is magnified by the turbulent waves of economic uncertainty. However, despite this volatility, discerning investors can discern a beacon of hope in companies like Albemarle. More than just a stock, it represents a time-tested resilience, a lighthouse amidst the stormy seas of market unpredictability.