Tobacco behemoth Altria Group (NYSE: MO) has etched its place as a stalwart in the realm of dividend stocks, offering a bounty of payouts to its investors over the past few decades. Despite weathering substantial legal challenges to the tune of billions of dollars, its products’ addictive nature has proven to be a reliable magnet, drawing investors towards its stock.

However, the luster of its flagship product, cigarettes, has dulled over the years as smoking rates continue to plummet. Potential investors would be wise to conduct a thorough examination of its overall business before diving in with hopes of reaping the rewards of its dividends.

The Allure of Altria’s Dividend

Altria dishes out $3.92 per share in annual dividends, equating to a dividend yield of 8.75% at its current price. This figure mandates an investment of $11,430 to pocket $1,000 annually. Notably, this yield towers over the S&P 500’s average of 1.3%. Moreover, Altria’s management has consistently upped the ante on dividends since 2009, with the previous instances of “dividend cuts” involving spinoffs that ultimately netted investors more stock, painting Altria’s dividend as a beacon of financial solace.

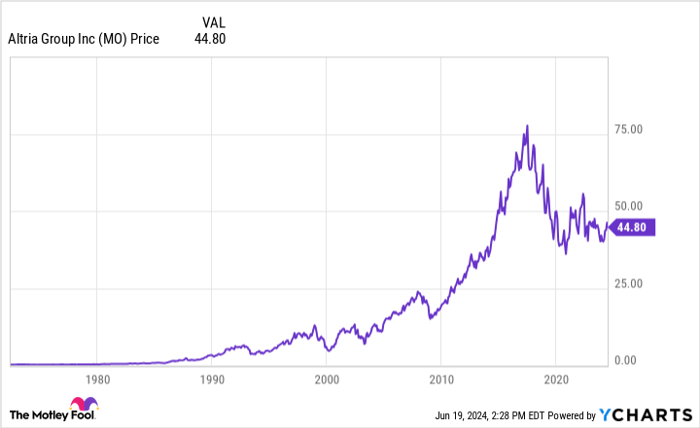

Remarkably, amidst the backdrop of the seminal surgeon general’s report on smoking hazards released six decades ago, Altria has defied the odds. Despite long-term dwindling smoking rates and hefty legal burdens, the stock and its dividends have witnessed remarkable growth.

However, a shadow looms over its financial landscape as its revenue took a hit in 2023 and seems poised to dip again in 2024. Disappointing investments in vaping company Juul and its significant losses in cannabis investments through Cronos Group cast a pall on Altria’s future. While a $2.75 billion bet on vaping company NJOY has been placed, should revenue growth fail to materialize, the dividend’s sustainability may falter.

The Verdict on Altria’s Dividend

Despite its tantalizing yield, investors should proceed with caution when eyeing Altria due to its dividend. Admittedly, both the stock and its payouts have defied expectations, surging over past decades. Yet, amidst a landscape of declining revenue and a lack of a clear growth trajectory laid out by management, potential investors might be better off seeking dividends elsewhere, even if it entails a heftier investment to attain a $1,000 payout.

Is Altria Stock Worth $1,000 Investment Now?

Before considering a plunge into Altria Group stock, weigh this:

The Motley Fool Stock Advisor analyst team recently pinpointed what they believe are the 10 best stocks for investors to currently buy… with Altria Group failing to make the cut. The chosen 10 stocks hold the potential for massive returns in the ensuing years.

Reflect on the moment when Nvidia graced this list on April 15, 2005 – investing $1,000 at the time of the recommendation would have blossomed into a staggering $830,777!

Stock Advisor armors investors with a lucid guide to flourish, providing insights on portfolio construction, routine analyst updates, and the unveiling of two fresh stock picks monthly. The service has outperformed the S&P 500’s returns more than fourfold since 2002.

*Stock Advisor returns as of June 10, 2024