Amidst the financial battleground, behemoths Chevron Corp (CVX) and Exxon Mobil Corp (XOM) tiptoed cautiously in the pre-market dance on Monday, struggling to recover from the bruising blows of the prior week. The looming specter of economic distress cast a dark shadow over both entities, with Chevron bearing the brunt of the storm.

Anxiety reached fever pitch following the unveiling of the August job dossier last Friday. A tepid job growth figure of 142,000 jobs, a modest increase from July but shy of the anticipated 161,000, coupled with an expected unemployment rate dip to 4.2%, painted a perplexing picture. Nonetheless, the “real” unemployment gauge surged to an alarming 7.9%, setting a wary tone in the investment realm.

The economic tremors reverberated in the energy sector, unsettling the pillars of WTI and Brent Crude. Lingering concerns were further heightened by deflated consumer confidence metrics in China, ruffling the feathers of major western brands. The impending threat of dwindling global hydrocarbon demand catalyzed a downward spiral in oil prices.

Adding fuel to the already combustible mix, geopolitical rumblings, particularly in the volatile Middle East, loom as a potential disruptor to the energy domain. The historical precedent of OPEC+ countries curbing production to prop up waning prices further muddies the forecasting waters.

Despite this maelstrom, glimmers of opportunity flicker in the hydrocarbon horizon. Recent Ukrainian drone strikes on Russian oil facilities wrought havoc on the aggressor’s infrastructure, potentially elevating oil prices through the guise of supply chain disruption. Long-term projections from the International Energy Agency foresee India emerging as a powerhouse in global oil demand, providing a counterbalance to the ebbing demand from the vast Chinese market up to 2030.

The ETF Landscape

Cognizant of the scales tipping both ways, investors eyeing the oil sector may find solace in the extensive portfolio of leveraged exchange-traded funds offered by Direxion. For the bullish brigade, the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (GUSH) beckon with a tantalizing 200% exposure to the S&P Oil & Gas Exploration & Production Select Industry Index.

Conversely, for the naysayers of the hydrocarbon narrative, the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares (DRIP) present an avenue to replicate 200% of the inverse performance of the aforementioned index. However, a cautionary note must be sounded – these leveraged twins are best left in the holster for no longer than a day to thwart the perilous compounding effect that may deviate fund performance from anticipated trajectories.

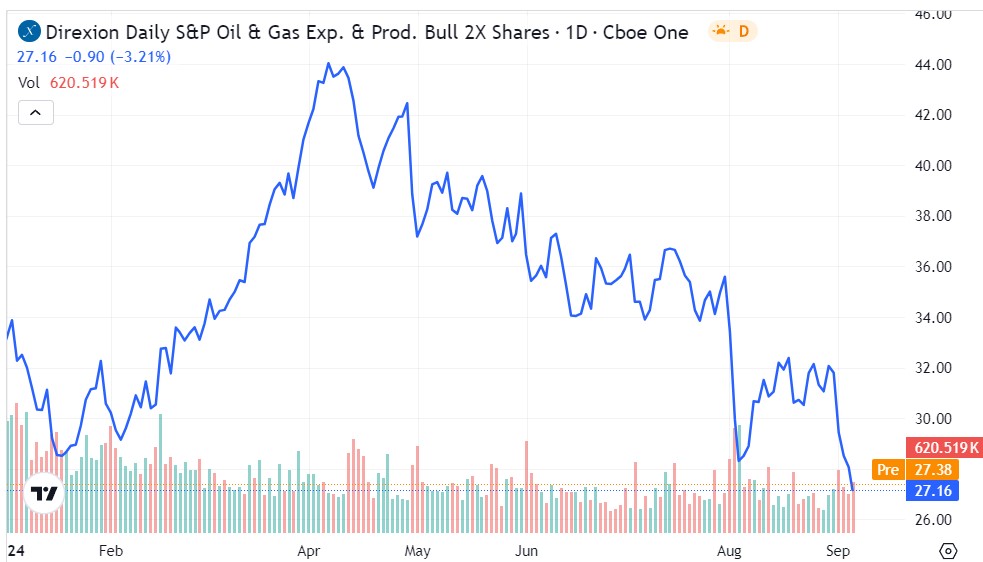

GUSH: The Bullish Runner

The year ushered GUSH in on a strong note, albeit a stumble early in January that was swiftly followed by an 18% dip in year-to-date performance. The recent sessions have left GUSH languishing below key support levels, triggering concerns. However, the long-resilient $27 price threshold stands as a bastion of hope, poised to stage a potential recovery bolstered by underlying fundamental drivers.

- As GUSH charts a path below its 50-day moving average ($32.84) and 200 DMA ($34.47), resolute investors pin hopes on the stalwart $27 line, bracing for a resurgence fueled by intrinsic catalysts.

DRIP: The Pessimist’s Play

In stark contrast, a tumultuous kickoff to 2024 plagued DRIP, succumbing to the bearish winds. However, the tides turned post-April as receding oil prices breathed life into the skeptics, propelling DRIP skyward with a striking 15% gain in market value.

- While the road ahead for the bear fund remains shrouded in uncertainty, recent bullish strides have propelled DRIP into a resistance battleground, spanning from $12 to $13, awaiting its fate.