Wells Fargo & Company experienced a 4% dip in its stock value in response to an announcement made in conjunction with the Office of the Comptroller of the Currency (OCC). This formal agreement focuses on addressing weaknesses within the bank’s anti-money laundering (AML) and sanctions risk management procedures.

The agreement highlights deficiencies in various areas of Wells Fargo’s anti-money laundering framework, such as reporting suspicious activities, managing currency transactions, customer due diligence practices, and the bank’s efforts in customer identification and beneficial ownership initiatives.

This unveiling comes following the bank’s earlier acknowledgment of the investigation in its second-quarter filing with the Securities and Exchange Commission (SEC). Within the filing, Wells Fargo disclosed being engaged in “resolution discussions” with the U.S. SEC regarding an investigation related to the cash sweep options offered to new investment advisory clients.

With the official accord with the OCC, Wells Fargo has taken a substantial stride towards fortifying its AML and sanctions risk management capabilities, aligning with the ongoing initiatives aimed at bolstering its risk management structures and compliance with regulatory mandates.

WFC’s management affirmed, “We have made significant headway in fulfilling the requirements outlined in the formal agreement and are steadfast in our commitment to expeditiously completing the necessary actions in line with our other regulatory obligations.”

Exploring the Nuances of WFC’s Agreement with OCC

The agreement necessitates the establishment of a Compliance Committee to monitor Wells Fargo’s compliance with the accord’s stipulations. The action plan must focus on key areas including front-line risk management, independent risk management, independent testing, customer identification, and the detection of suspicious activities.

Furthermore, the agreement mandates that the bank enhance its AML and sanctions risk management protocols, secure the OCC’s approval for assessing the AML and sanctions risks associated with new products, and notify the OCC before expanding the scope of these offerings.

Challenges Beyond the Horizon for WFC

Since September 2016, Wells Fargo has grappled with a series of hurdles, facing penalties and sanctions that culminated in the Federal Reserve imposing a cap on its asset position.

Adding to its woes, the bank encountered a class action lawsuit in July 2024, citing mismanagement of its employee health insurance scheme. Allegations suggested that thousands of U.S.-based employees were overcharged for prescription medications due to the inflated prices paid by Wells Fargo’s health plan to pharmacy benefit managers.

In June 2024, another proposed class action lawsuit emerged, accusing Wells Fargo of participating in a Ponzi scheme worth $300 million. Over 1,000 investors, predominantly senior citizens, were victims of this fraudulent scheme, which depleted their life savings. The lawsuit contended that Wells Fargo was complicit in the scheme from 2011 to 2021, providing substantial assistance to the perpetrators while reaping benefits from the illicit activities.

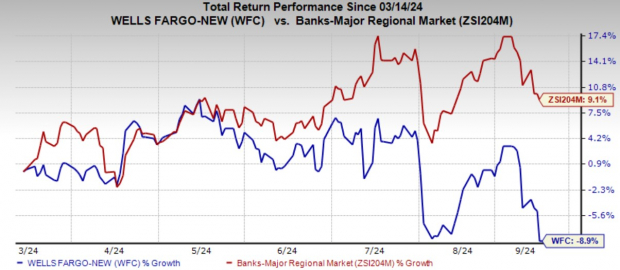

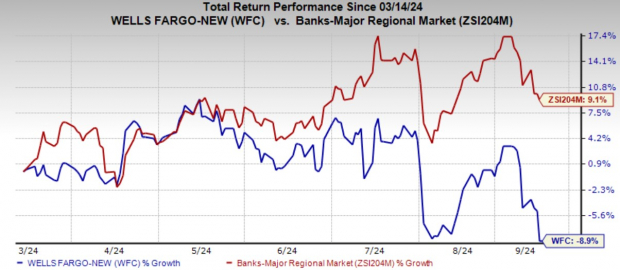

Over the past six months, Wells Fargo’s shares have depreciated by 8.9%, trailing behind the industry’s growth rate of 9.1%.

Image Source: Zacks Investment Research

Wells Fargo currently holds a Zacks Rank #3 (Hold).

Litigation Probes Targeting Other Finance Firms

On September 11, 2024, The Toronto-Dominion Bank (NYSE: TD) settled with the Consumer Financial Protection Bureau (CFPB) by agreeing to pay a $28 million penalty over credit reporting discrepancies. The bank faced accusations of mishandling customer credit information and failing to rectify the identified shortcomings.

Similarly, Robinhood Markets, Inc.’s (NASDAQ: HOOD) cryptocurrency platform is set to pay $3.9 million in a settlement with the California Department of Justice for preventing customers from withdrawing cryptocurrency between 2018 and 2022. The California Attorney General noted that Robinhood’s actions violated state laws and disadvantaged customers by impeding their ability to access their assets.

All information provided here is purely informative and does not serve as professional investment advice.