When deep-pocketed investors start playing the bullish tune on a stock like Caterpillar, it’s akin to a bat signal lighting up the financial skyline. It’s a signal that should make even the most steadfast market spectator perk up with attention. And when the team at Benzinga teases out this pivotal move from the shadows, the stage is set for something momentous.

The thunderous drum roll of activity in Caterpillar’s options today rumbled at a pitch not often heard. Benzinga’s options scanner picked up on 22 extraordinary maneuvers in the Caterpillar jungle – something worth noting in the wild world of finance.

The mood among these financial gladiators was anything but tame – a bullish army on one side and a bearish brigade on the other. Among the notable options, 14 puts totaling a hefty $1,288,875 faced off against 8 calls amounting to $389,403. The battleground was set.

Peering into the Crystal Ball: Expected Price Movements

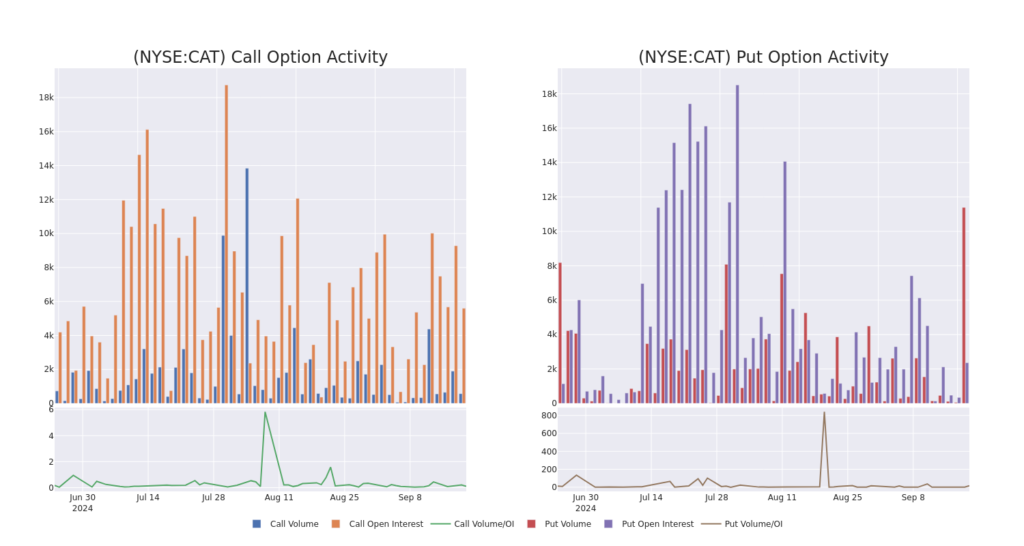

Casting our gaze over trading volumes and Open Interest, the machinations of the market movers point to a battleground swathed in a price band stretching from $310.0 to $450.0 for Caterpillar over the past three months. The stage is set for a showdown.

Unpacking the Numbers: Analyzing Volume & Open Interest

As liquidity flows and interests tango in the financial ballroom, the average open interest in Caterpillar options trades today stands at a robust 723.82 against a total volume of 11,962.00. The arena is abuzz with activity.

In a chart tracking the symphony of volume and open interest of call and put options for Caterpillar’s high rollers betwixt a strike price range of $310.0 to $450.0 over the past 30 days, the plot thickens.

The Epicenter of Action: Largest Options Trades Observed

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | PUT | SWEEP | NEUTRAL | 11/15/24 | $9.15 | $9.0 | $9.07 | $350.00 | $546.3K | 1.2K | 634 |

| CAT | CALL | TRADE | BULLISH | 03/21/25 | $5.65 | $5.3 | $5.65 | $450.00 | $141.2K | 136 | 250 |

| CAT | PUT | SWEEP | BULLISH | 11/01/24 | $7.55 | $6.85 | $6.85 | $350.00 | $123.3K | 27 | 200 |

| CAT | PUT | SWEEP | NEUTRAL | 11/15/24 | $9.05 | $8.95 | $9.02 | $350.00 | $95.5K | 1.2K | 1.3K |

| CAT | PUT | SWEEP | NEUTRAL | 11/15/24 | $8.8 | $8.75 | $8.79 | $350.00 | $89.7K | 1.2K | 1.5K |

Unveiling the Giant: About Caterpillar

Caterpillar, the colossus in the heavy equipment realm, reigns as the world’s heavyweight champion in manufacturing heavy equipment. With divisions spanning construction industries, resource industries, energy and transportation, and Cat Financial, its empire casts a shadow across the global landscape with a dealer network boasting about 2,700 branches under the watchful eye of 160 dealers. Cat Financial sprinkles financial magic by providing retail and wholesale financing – a tempting bait for Caterpillar product aficionados.

With the options market buzzing around Caterpillar like bees to honey, it’s time to zoom in on the company’s own performance.

A Glimpse into the Present: Current Position of Caterpillar

- Trading at a volume of 5,177,212, CAT’s price has dipped by -1.13% to $369.1.

- The arcane RSI indicators wisp whispers of an approaching overbought stock.

- The countdown has begun for the next earnings release in a mere 39 days.

Can $1000 metamorphose into $1270 in just 20 days?

A seasoned options trader of 20 years has unveiled his one-line chart trick to detect the perfect buy and sell moments. His trades boast a remarkable 27% average profit every 20 days. Peek behind the curtain for access.

Options trading unfurls a realm of heightened risks and gleaming rewards. The wise in the trade navigate this entangled jungle by perpetually enriching their knowledge, morphing strategies, monitoring myriad indicators, and keeping a hawk-eye on market shudders. Stay attuned to the latest Caterpillar options escapades with real-time alerts from Benzinga Pro.