The stock market can be like a high-stakes game of musical chairs. Just when you think you’ve found a seat, the music changes, and someone else grabs the spotlight. For years, Apple (AAPL) has held the coveted title of the world’s biggest company, with only brief interruptions from contenders like Microsoft (MSFT). But in a dramatic turn of events, Nvidia (NVDA) recently pulled off a coup, surpassing both tech behemoths to claim the throne as the most valuable company in the world.

Nvidia Surges Past Microsoft to Claim the Crown

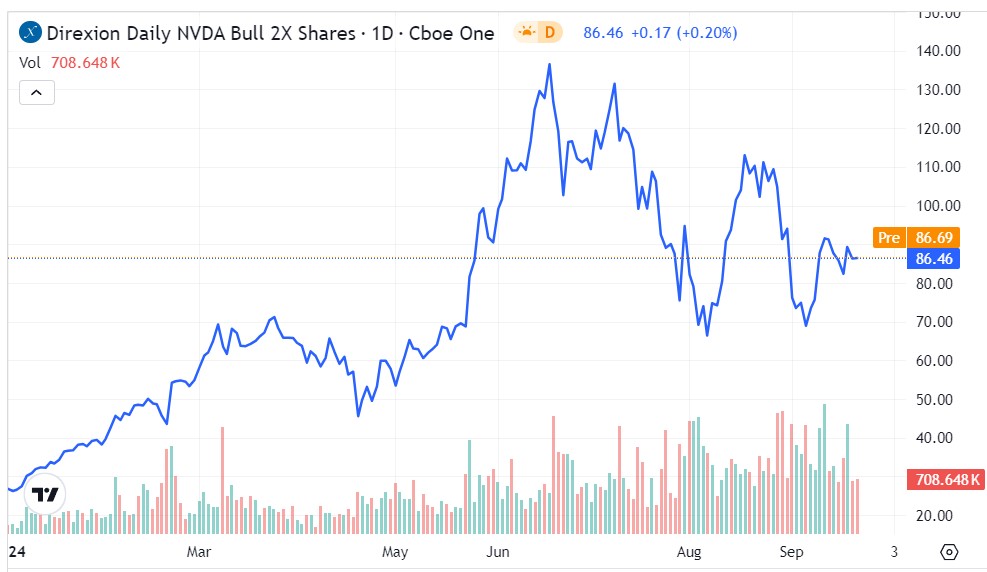

The meteoric rise of Nvidia has been nothing short of awe-inspiring. In the last two decades, the company’s stock has skyrocketed by over 79,000%, a jaw-dropping figure that seems almost surreal. The visionary leadership of Jensen Huang has propelled Nvidia to unforeseen heights, culminating in its unprecedented ascent to the world’s top spot, a feat few could have predicted.

Central to Nvidia’s success has been its strategic pivot towards artificial intelligence (AI). The company’s cutting-edge chips now underpin the foundation of large language models (LLMs) developed by industry titans like Meta Platforms, Amazon, and Alphabet. This shift has not only revitalized Nvidia but also positioned it as a key player in shaping the future of technology.

Rosenblatt’s Bullish Prediction for Nvidia’s Future

Market analysts tracking Nvidia have been in a frenzy, continually revising their target prices in response to the stock’s breathtaking surge. Like Apple, Nvidia now trades above its consensus target price, reflecting the market’s struggle to keep pace with its exponential growth. With a new Street-high target price of $200, as forecasted by Rosenblatt, Nvidia’s market cap is poised to soar to nearly $5 trillion, a staggering projection that underscores the company’s phenomenal trajectory.

Forecasting the Trajectory of Microsoft

Unlike its counterparts, Microsoft’s mean target price of $492.71 stands at a premium of 10.4% above its recent closing prices. The stock’s Street-high target price of $600 represents a 34.4% increase that could propel the Redmond-based giant’s market cap to nearly $4.5 trillion, signaling strong potential for growth.

The Tight Race to Dominate: Apple, Microsoft, and Nvidia Square Off

With Apple, Microsoft, and Nvidia locked in a tight race for market supremacy, the competition is heating up as each company vies for the top spot by the end of 2024. As industry experts observe this fierce battle, speculations abound on which tech titan will emerge victorious in the race to reach a $4 trillion market cap.

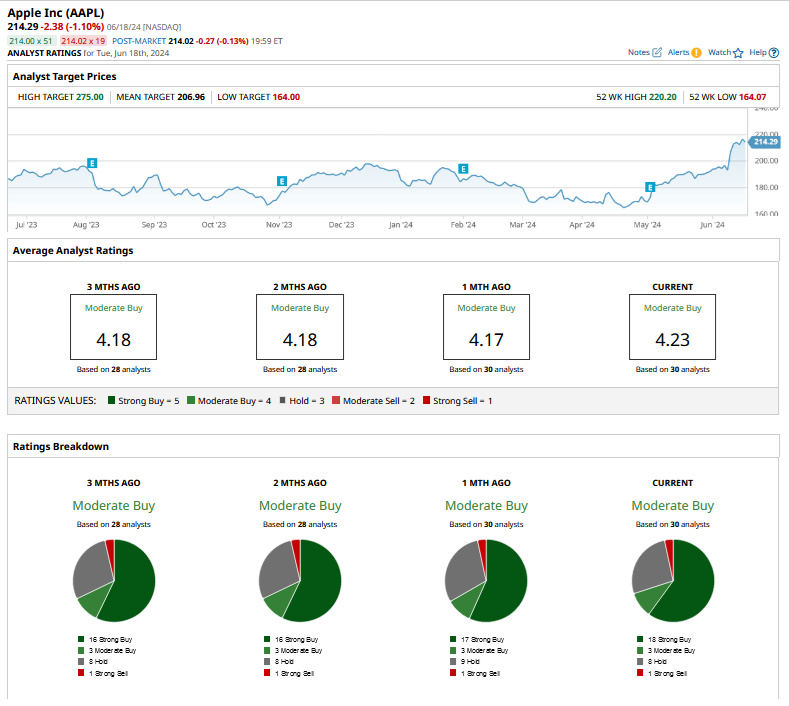

While some analysts bet on Nvidia’s continued momentum, others like Gene Munster foresee Apple outshining its rivals in the coming year, emphasizing the untapped potential of Apple’s AI initiatives. Nonetheless, cautionary voices warn of a possible correction for Nvidia, urging investors to tread carefully amidst the fervor.

As Apple strives to showcase its “Apple Intelligence” and Microsoft capitalizes on AI-driven opportunities, the stage is set for a showdown of epic proportions among these tech giants in the realm of artificial intelligence.

As the curtain rises on round 2 of the AI pivot, investors brace themselves for an intense showdown between Apple, Microsoft, and Nvidia as they jostle for the ultimate prize in the high-stakes game of market dominance.