Nvidia (NVDA) wowed investors once again with its fiscal Q1 2025 earnings, increasing its market cap by $200 billion in a single day – a figure surpassing 1.5 times Intel’s market value. The company’s phenomenal growth trajectory has seen its market cap soar to over $2.5 trillion, a staggering achievement considering it only reached the $1 trillion milestone last year, and vaulted past $2 trillion earlier this year.

The Earnings Phenom

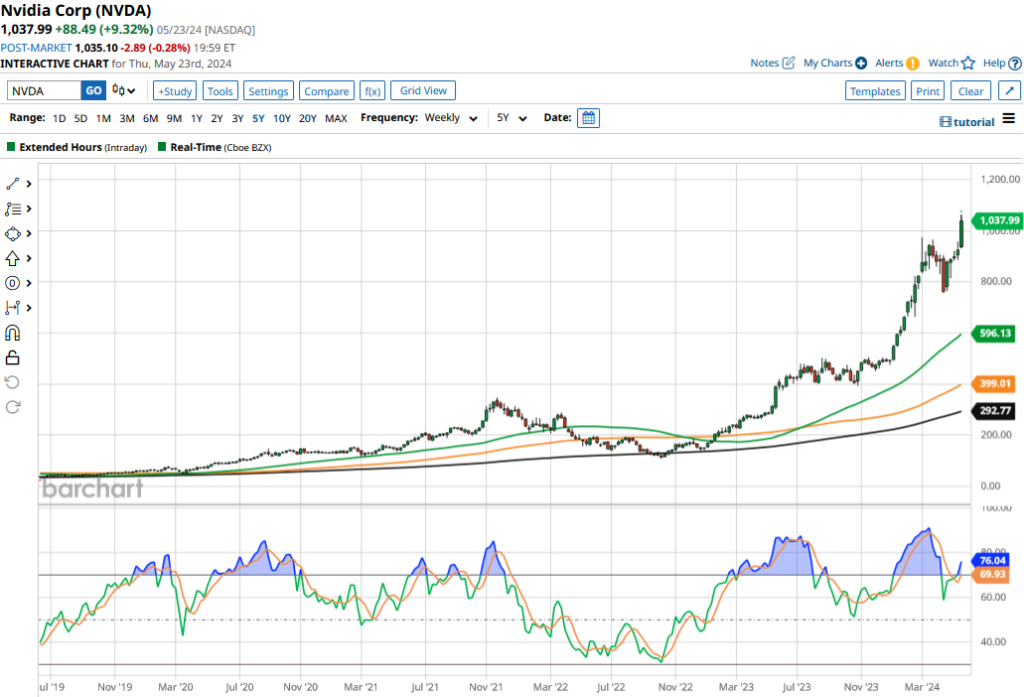

Following a record-breaking $277 billion market cap boost after its fiscal Q4 earnings, Nvidia has announced a jaw-dropping 10-for-1 stock split, reflecting a 25-fold increase in share value over the last five years. The only company in the “Magnificent 7” reporting triple-digit revenue growth, Nvidia’s stellar financial performance has left industry giants in its wake.

The Earnings Marvel

Nvidia’s fiscal Q1 earnings came in at a revenue of $26.04 billion, surpassing analyst projections by a significant margin. The company’s earnings per share (EPS) of $6.12 exceeded consensus estimates, reaffirming its growth trajectory. With a projected revenue of $28 billion for the current quarter, Nvidia is once again outperforming market expectations.

The AI Growth Odyssey

Nvidia’s transition to the new Blackwell chips has investors on edge, but assurances from CEO Jensen Huang that Blackwell revenue will come in this year have calmed anxieties. Major players like Meta Platforms and Tesla utilizing Nvidia’s chips for AI projects hint at sustained growth, with cloud providers seeing significant returns on investments in Nvidia’s AI infrastructure.

Vying with insatiable demand, Nvidia continues to outpace rivals as Big Tech firms and startups scramble to secure its AI chips in the midst of an AI frenzy.

Prognostications for NVDA Stock

Analysts are in a frenzy raising their target prices for NVDA, with Benchmark and Bank of America hiking their projections significantly post-earnings. With Rosenblatt setting the Street’s highest target price at $1,400 – representing a 33% increase from current prices – enthusiasm remains unabated. NVDA retains a “Strong Buy” consensus as analysts are captivated by its extraordinary growth narrative.

Charting NVDA’s Trajectory

Nvidia’s relentless climb to the top has left many dazzled by its unparalleled ascent. As it eyes a $3 trillion market cap and potentially surpassing Microsoft to become the world’s largest company, the sky seems to be the limit for this AI powerhouse.

Trading at a forward P/E multiple of 40x, second only to Tesla among the Magnificent 7, Nvidia’s prospects remain bright. Unrivalled in the AI space, with demand showing no signs of waning and competition struggling to keep pace, Nvidia reigns supreme in the AI revolution.