Apple (NASDAQ: AAPL) has been a rollercoaster for investors, skyrocketing nearly 250% over the past five years, leaving the S&P 500 index trailing far behind at a mere 77% in gains. Dubbed the “Magnificent Seven,” the tech behemoth’s ascent has been propelled by a booming high-margin services division and an explosive 5G smartphone upgrade cycle.

However, the tide has turned in 2024, with Apple stock dipping by almost 5%, lagging significantly behind the S&P 500.

Berkshire Hathaway, led by the revered Warren Buffett, slashed its Apple holdings by 13%. Concerns loom among analysts and investors as Apple appears to be lagging in key tech trends like artificial intelligence (AI). With competitors such as Samsung leveraging AI to amplify smartphone sales, Apple’s recent performance suggests a dwindling demand for iPhones.

Yet, a deeper inspection of Apple’s potential catalysts unveils a promising outlook for the next five years.

Apple’s Strategic Drivers for a Turnaround

Following the release of Q2 fiscal 2024 results on May 2, Apple witnessed a 6% surge in its stock price. The rally was fueled by stellar numbers as the company posted earnings of $1.53 per share on revenue of $90.8 billion, surpassing analyst estimates. Additionally, Apple amped up its quarterly dividend by 4% to $0.25 per share and unveiled a mammoth $110 billion share buyback program, a record-setting move in U.S. history. Tim Cook’s affirmation of investments in generative AI further buoyed investor morale.

Cook’s optimistic stance during the earnings call, mentioning significant investments and teasers of exciting forthcoming developments, circumvented the year-over-year revenue and earnings dip from the previous quarter.

Amid a 4% drop in revenue and minor earnings decline year over year, Apple’s dominant revenue stream, the iPhone, shrank from $51.3 billion to $46 billion. A strategic pivot towards generative AI features in upcoming iPhones seems inevitable, especially as Samsung reaps rewards from its AI-driven Galaxy lineup, enticing half of customers with AI functionalities and engaging 60% of users actively.

Forecasts suggest that generative AI-capable smartphone shipments could quadruple by 2027. Analysts anticipate Apple entering this domain by 2024 and seizing the prime spot as the top smartphone OEM by 2025, mirroring its 5G smartphone market takeover post-iPhone 12 launch in 2020.

AppleInsider hints at Apple’s possession of a large language model (LLM), likely furnishing advanced AI features from text summarization to chatbot-like responses in apps such as Siri, Safari, and Messages. These enhancements could spur iPhone upgrades and carve a niche in the burgeoning AI smartphone segment, pointing towards a potential iPhone renaissance in the wake of the AI revolution.

Propelled Earnings Miracle for Potential Stock Bonanza

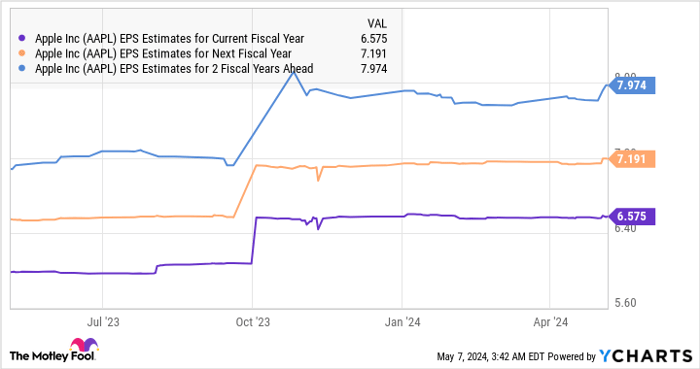

Apple’s earnings plateaued at $6.13 per share in fiscal 2023 but are poised for a ramp-up depicted in this chart. Forecasts indicate a robust double-digit growth trajectory spanning the next five years.

AAPL EPS Estimates for Current Fiscal Year data by YCharts

Analysts project sustained double-digit earnings growth of 11% for the next five years. Extrapolating from the $6.13 per share earnings of fiscal 2023, bottom-line figures could soar to $10.33 per share in half a decade. Apple holds a modest forward earnings multiple of 28, slightly under the Nasdaq-100 index’s multiple of 29.5.

Bright Horizons: Apple’s Stock Poised for Significant Growth

In a world where the future of tech stocks seems as unpredictable as a game of roulette, Apple stands out like a dazzling gem, offering investors a beacon of hope. Pioneering innovation, unwavering consumer loyalty, and a steady track record have positioned Apple as a formidable player in the tech arena.

Potential Upswing in Stock Price

As the dust settles in the turbulent landscape of the stock market, Apple emerges as a promising candidate for investors seeking handsome returns. If projections hold true and Apple maintains its current P/E ratio of 28 over the next five years, its stock price could skyrocket to $289, reflecting a robust 57% increase from its current valuation. This growth trajectory places Apple at a discount compared to the Nasdaq-100, making it an attractive proposition for discerning investors.

Historical Comparisons and Investment Insights

Reflecting on historical milestones can provide valuable insights into future investment opportunities. Consider the case of Nvidia, a tech giant that graced the coveted list of top stocks back in 2005. Investors who had the foresight to invest $1,000 at the time would have reaped a staggering $550,688 return. Such success stories underscore the potential for exponential growth inherent in the technology sector.

The Motley Fool Stock Advisor presents a roadmap to financial prosperity, offering investors a curated selection of stocks poised for significant returns. While Apple may not feature among the current top 10 recommendations, the stocks endorsed by this advisory service have consistently outperformed the S&P 500, showcasing their exceptional ability to generate substantial profits for investors.

Guidance for Potential Investors

For those contemplating an investment in Apple, it is important to weigh the long-term growth potential against the inherent risks of the market. With a proven track record of driving innovation, expanding its product ecosystem, and retaining a loyal customer base, Apple appears well-positioned to deliver healthy returns over the coming years.

As the investment landscape continues to evolve, strategic decisions guided by thorough research and prudent analysis can pave the way for lucrative outcomes. By staying informed, diversifying portfolios, and capitalizing on emerging opportunities, investors can navigate the complex terrain of the stock market with confidence.