Novo Nordisk (NYSE: NVO) has proven to be a stellar performer, outpacing the market significantly over the past decade. With a remarkable 10-year return of 527%, dwarfing the S&P 500‘s gain of 182%, the company has certainly caught investors’ attention.

While its recent surge in 2022 propelled the stock to new heights, driven largely by the success of its product Ozempic, questions loom around its future trajectory. As Novo Nordisk cements its position as one of the premier healthcare stocks globally, concerns arise about its capacity to sustain such remarkable growth in the years ahead.

The Landscape of the Weight-Loss Market

Novo Nordisk’s rise to prominence can be chiefly attributed to its flagship product, Ozempic. Despite being designed for diabetes management, Ozempic has inadvertently become synonymous with weight-loss solutions, captivating audiences and sparking a social media frenzy. However, over the next decade, as competition intensifies and new contenders emerge, the narrative could shift.

Companies like Eli Lilly with Mounjaro and Zepbound, as well as Roche and Viking Therapeutics, are actively pursuing their share of the lucrative weight-loss market. The emergence of new players and innovative products could challenge Novo Nordisk’s dominance, potentially altering the market dynamics significantly in the coming years.

Projected Growth Trajectory

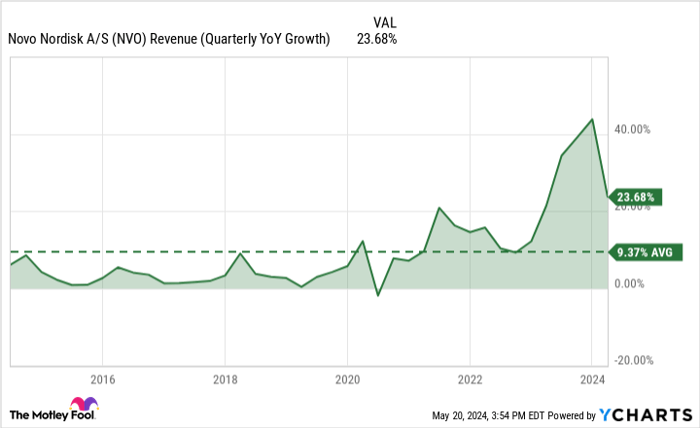

With first-quarter sales in 2024 reaching 65.3 billion Danish krone ($9.8 billion) and marking a substantial 22% year-over-year increase, Novo Nordisk continues to demonstrate robust growth. Leveraging its obesity care products, specifically Wegovy, which surged by 41%, the company is expanding its footprint in the market.

However, as competition mounts and the industry landscape evolves, sustaining the current growth rate might pose challenges for Novo Nordisk. While avenues for further expansion remain open, investors must brace themselves for a more tempered growth outlook compared to the company’s historical performance.

Evaluating Future Investment Potential

Trading at 45 times its trailing earnings and over 16 times its book value, Novo Nordisk faces high valuation expectations. The stock’s current price likely factors in a considerable portion of its anticipated future growth, necessitating a cautious approach for prospective investors.

Anticipating a more subdued growth trajectory compared to its previous meteoric rise, Novo Nordisk might not replicate its extraordinary 500% returns over the next decade. Nevertheless, a doubling of its stock value and a market cap of $1 trillion could be within reach, provided it maintains an average annual growth rate of 6%.