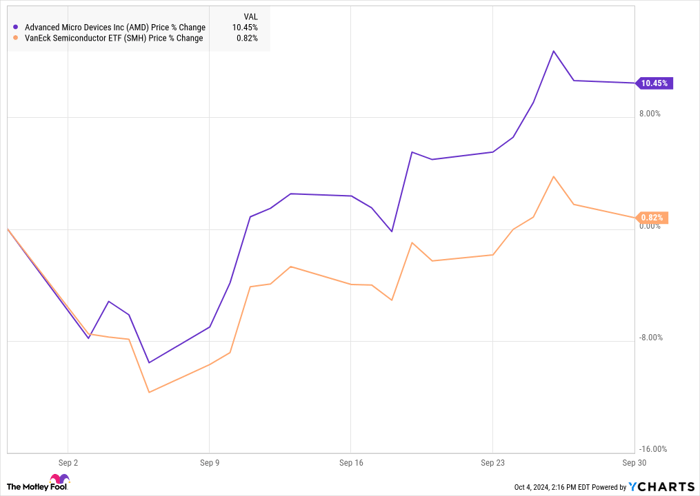

Advanced Micro Devices (NASDAQ: AMD) saw a remarkable 10% surge in stock price in September, riding a wave of bullish news and favorable market conditions. Amid the Federal Reserve’s 50-basis-point cut and a broader upswing in the semiconductor industry, AMD outpaced its peers, exemplified by the VanEck Semiconductor ETF.

The stock’s movement highlighted AMD’s resilience and growth potential, setting the stage for a compelling narrative that investors were keen to follow.

AMD’s Rise in the AI Arena

AMD’s strategic positioning in the AI sector has been a driver of its success. With the recent introduction of its MI300 data center GPU, the company has been gaining traction as a significant AI product supplier.

In September, a series of positive developments propelled AMD’s stock upwards.

AMD’s announcement of the “Advancing AI 2024” event scheduled for October 10 created buzz in the market. The unveiling of the next-generation AMD Instinct accelerators and fifth-gen AMD Epyc server processors drove enthusiasm among investors.

The market’s focus on AI was evident as AMD’s stock surged 5% following the AI-centric event announcement on September 11. Additionally, Cathie Wood’s Ark Invest increased its AMD holdings by 45,500 shares, signaling confidence in AMD’s growth trajectory.

The subsequent week brought more good news for AMD as Reuters reported AMD’s victory over Intel in securing a critical chip design deal for Sony’s PlayStation 6. Citigroup’s endorsement of AMD as a top AI pick further fueled investor optimism. AMD also benefited from the Federal Reserve’s rate cut on September 19, reflecting an overall positive market sentiment.

AMD closed the month on a high note with Oracle Cloud Infrastructure’s decision to adopt AMD’s Instinct MI300X accelerators. This move positioned AMD as a viable competitor to Nvidia in the AI accelerator market, amplifying its standing in the industry.

![]()

Image source: Getty Images.

What Lies Ahead for AMD?

The eagerly anticipated AI presentation on October 10 is poised to be a catalyst for AMD’s trajectory. Investors are awaiting potential game-changing product releases that could solidify AMD’s standing, particularly in the competitive data center GPU market.

If AMD delivers on its promises and successfully challenges Nvidia, the stock may have significant growth opportunities beyond its September surge.

Investing in Advanced Micro Devices

Before diving into Advanced Micro Devices stock, investors should carefully assess the company’s prospects. While AMD witnessed a stellar September, other investment opportunities might offer even greater potential returns.

The Motley Fool Stock Advisor team recently highlighted the 10 best stocks for investors, with Advanced Micro Devices not making the cut. This insight illustrates the need for thorough analysis and consideration of alternative investment avenues.

Reflecting on past successes, such as Nvidia’s inclusion in similar lists in the past, underscores the transformative potential of strategic investments. A prudent approach to stock selection, like the Stock Advisor service’s proven track record, could significantly enhance investment outcomes.

Explore the 10 recommended stocks

*Stock Advisor returns as of September 30, 2024