When the market starts humming, it’s akin to watching a symphony of soaring stocks, like an orchestra of opportunity. Today, the melodies of electric vehicle (EV) stocks such as Tesla (NASDAQ: TSLA), Rivian (NASDAQ: RIVN), and QuantumScape (NYSE: QS) echoed louder, showcasing a 4.3%, 8.8%, and 4.3% uptick, respectively, as of 2:28 p.m. ET.

Despite the absence of company-specific revelations, the driving force behind this surge can be attributed to the mellifluous tones of Federal Reserve Chair Jay Powell’s dovish speech at the Portneuf Health Trust Amphitheater in Jackson Hole.

For stocks that have weathered the storm of rising interest rates in recent times, the prospect of a rate cut would breathe new life into their sails. EV stocks, battered by the impact of increasing rates, stand to gain significantly from this harmonious change in tide.

The overture began when Powell announced, “The time has come for policy to adjust,” during his keynote address. This resonant statement, more definitive than anticipated, signals an impending interest rate reduction by the Fed, possibly even by 50 basis points. The Fed’s decision follows previous months where rates remained static at cyclical highs. Recent layoffs, dwindling inflation figures, and sluggish job growth have raised concerns that the Fed’s rate cut may be a tad too late, potentially steering the economy towards a downturn.

However, Powell exuded confidence in envisaging a “soft landing,” foreseeing diminished inflation and interest rates without substantial job loss. The key takeaway emanated from his address: the importance of anchored inflation expectations, buttressed by decisive actions from the central bank in fostering disinflation without relying on slack in the labor market.

EV stocks, a segment hit hard by high interest rates, responded with fervor. The rationale was crystal clear. Rising rates exerted pressure on EV firms through two main avenues.

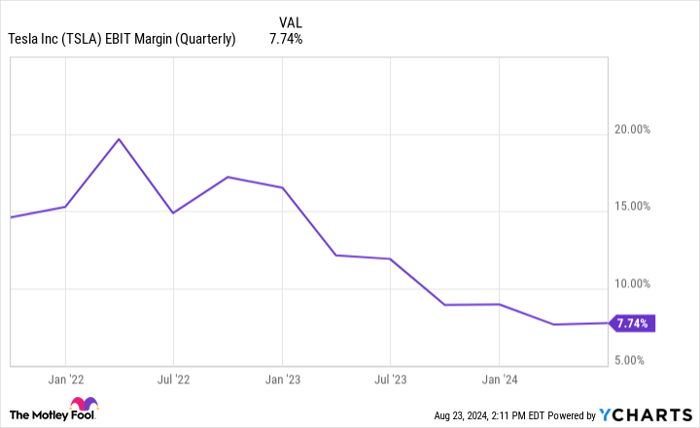

Firstly, escalating rates inflated the cost of car loans; a significant concern given that cars, especially EVs, are high-value purchases. Consequently, EV companies, including front-runner Tesla, resorted to price cuts to drive sales amid softened demand, ultimately squeezing profit margins.

Secondly, high-interest rates elevated capital costs and hurdle rates, spelling bad news for low-profit entities like Rivian and QuantumScape, as well as high-multiple equities such as Tesla. For companies reliant on future profits, soaring rates chip away at the present value of these earnings. Additionally, loss-making firms might need to tap additional capital, and with higher interest rates, the cost of capital intensifies, a factor that curtails intrinsic value.

Thus, a rate cut, devoid of an imminent recession, spells relief for EV stocks on these pivotal fronts.

Image source: Getty Images.

Navigating the Rapids: Challenges Beyond Rates

While a rate reduction promises a substantial boon, it’s vital to remember that unlike other sectors, automotive production unfolds in a capital-intensive, cyclical, and cutthroat low-margin environment. As a result, established automobile firms often trade at subdued P/E multiples.

Although each of these companies seems poised at the vanguard today, the path ahead is beset with thorns. Tesla, famed for its technological prowess, is staking big on robotaxis – a risky gamble teetering on uncertainty while competitors edge closer to challenging its EV supremacy.

Rivian stands tall with enviable partnerships, notably with heavyweights like Amazon and Volkswagen. However, the company recorded a staggering $1.4 billion operating loss in the last quarter alone, raising apprehensions over its journey toward profitability.

On the other hand, QuantumScape, still in the pre-revenue phase, strives to commercialize its solid-state battery innovation. While the promise of these batteries revolutionizing the auto industry looms large, the company grapples with mounting losses, standing at a daunting $134 million operating deficit last quarter with less than $1 billion cash left in its coffers.

Notably, QuantumScape’s recent pact with Volkswagen not only infuses much-needed capital through a tech license but also entails ceding intellectual property to the automotive giant in the future. While these deals aim to shore up cash reserves for Rivian and QuantumScape, they could also signal Volkswagen’s shrewd maneuvering to acquire cutting-edge tech at bargain prices considering the distressed state of both firms.

As the puzzle unravels, it’s evident that interest rates are but a lone piece. With the auto industry facing disruption from EV and autonomous technologies amidst high degrees of uncertainty, diving into this sector demands nerves of steel, even in a lower-rate environment.

Charting the Course: To Invest or Not in Tesla?

Before setting sail with Tesla, weigh anchor with caution:

The Motley Fool Stock Advisor team uncovered what they deem as the 10 best stocks for investors to navigate through the stock market’s ebbs and flows, where Tesla did not make the cut. These selected stocks are poised to yield sizeable returns in the foreseeable future.

Recall the bygone era when Nvidia graced this list on April 15, 2005; an investment of $1,000 during that juncture would have burgeoned into a staggering $758,227 today!*.

With a roadmap to prosperity, Stock Advisor lays out a user-friendly blueprint for success, offering insights on portfolio construction, regular analyst updates, and two fresh stock picks each month. Since 2002, the Stock Advisor service has surpassed the S&P 500 returns manifold.*

*Stock Advisor returns updated as of August 22, 2024