This is the third version of this headline I’ve published in this newsletter. And the answer may finally be yes: A spot bitcoin exchange-traded fund (ETF) may begin trading in the U.S. in the coming weeks.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

The Growing Buzz Around a Bitcoin ETF

Excitement over a spot bitcoin ETF – a regulated financial product that would give institutional and retail investors easier exposure to bitcoin’s price without requiring them to invest directly in the asset – continues to grow.

Significance of SEC’s Deadline

The U.S. Securities and Exchange Commission (SEC) faces a Jan. 10 deadline for approving an application from Ark 21 Shares. It’s widely seen as the final date by which the SEC may approve or reject the more than a dozen outstanding applications.

Possible Approval in the Near Future

A number of signs point to an approval in the near future – like continued meetings between SEC staff, exchanges, and would-be issuers, as well as a flurry of filings.

SEC staff met with representatives from the markets that want to list the products – the New York Stock Exchange, Nasdaq, and Cboe Global Markets – on Wednesday afternoon, an individual told CoinDesk.

Fox Business first reported that the meetings were taking place, saying SEC attorneys from the Division of Trading and Markets met with representatives from the exchanges.

Debate Over Creation Model

Over the past few weeks, SEC staff have also met with issuers to address various aspects of their S-1 filings, including having all issuers use a cash creation and redemption model instead of in-kind.

Cash creation means what it sounds like: Authorized participants will purchase shares of the ETFs from the issuers using cash, rather than directly acquiring the underlying asset.

Companies like BlackRock and Grayscale have argued before the SEC that the regulator should be comfortable with and allow in-kind creation. Georgetown University Associate Professor James Angel similarly argued in a letter to the regulator that only allowing cash creation would end up adding fees and other frictions to the various parties.

Procedural Steps

Also on Wednesday, Fidelity filed a form 8-A, which allows exchanges to list shares. While this form doesn’t in and of itself mean the product has been approved, it is a procedural step that must be taken if approval does arrive. An individual at another would-be issuer said their company would also have to file a form 8-A.

James Seyffart, an analyst with Bloomberg Intelligence, said the filing is a registration that’s needed for the shares to begin trading.

Anticipation and Actions

“What will actually dictate SEC approvals is 19b-4 and S-1 approvals,” he said.

In the meantime, we have seen a number of amended filings addressing the cash creation model and naming authorized participants.

And seemingly riding on the wave of excitement, the T-REX Group (yes, really) filed for a number of inverse and long spot bitcoin ETFs, presumably in anticipation of a spot trust product approval. None of these actions are smoking guns, but they all hint at a likely approval.

This week

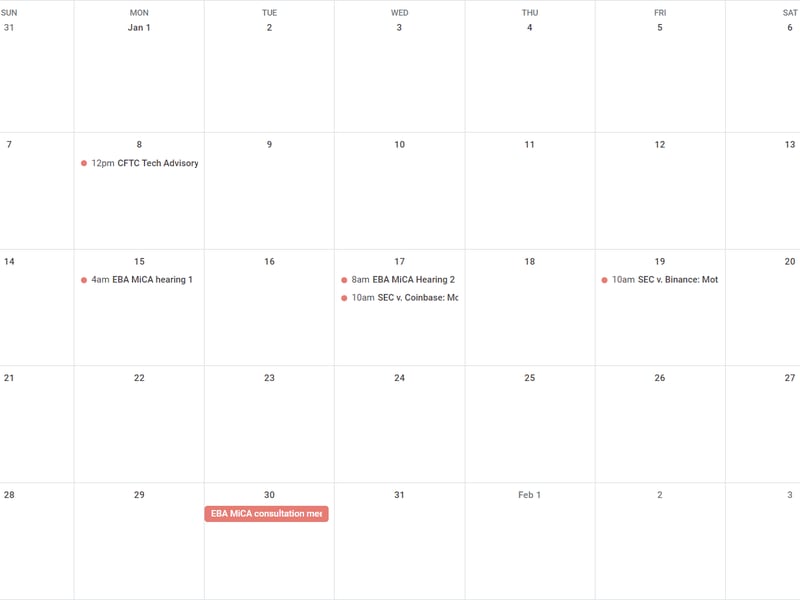

- This week is quiet. Next week, not so much.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!