Key Findings from Q2 Earnings Report

For the 134 S&P 500 companies that have reported Q2 results, total earnings are up +7.6% from the same period last year on +4.7% higher revenues. Earnings have surpassed estimates with 81.3% beating EPS estimates and 57.5% beating revenue estimates.

Although the revenue beats percentage is slightly lower than previous quarters, other performance metrics are showing improvement.

Impressive Growth Trend

In Q2, total earnings for the S&P 500 index are expected to rise by +9.6% compared to the previous year, indicating the highest growth pace since Q1 2022.

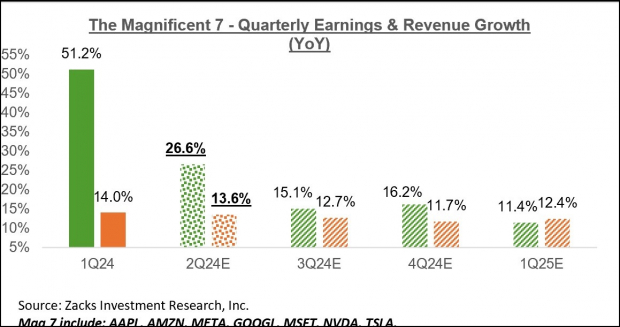

The ‘Magnificent 7’ companies are projected to lead the charge with an expected Q2 earnings increase of +26.6% and a revenue surge of +13.6%. This marks a substantial growth compared to the rest of the index.

Alphabet and Tesla initiated the Q2 reporting cycle for the ‘Mag 7’. Whereas Tesla faced challenges and missed estimates, Alphabet beat expectations. However, Alphabet’s increased capital spending led to market disappointment.

The prevailing sentiment seems to focus on excessive spending rather than the positive outcomes from investment, especially in the tech sector. Investors are keen on visible returns from AI investments by companies like Alphabet.

Tech Sector Outlook

Overall, Q2 earnings for the tech sector are anticipated to grow by +16.3% year-over-year. Strong earnings are expected to continue in the coming years, with Tech sector earnings forecasted to rise by +17.2% in 2024.

Record margins in the tech sector are a significant contributor to the optimistic earnings outlook. Margins in 2024 are expected to surpass the previous year’s record levels. This trend is attributed to the increasing dominance of higher-margin software and services, as well as the anticipated productivity gains from AI integration.

Broader Earnings Landscape

This year’s +8.7% earnings growth, partly driven by revenue increases in sectors like Finance, underscores the sectoral variance in performance. Excluding Finance, earnings growth is at +8.5%, with margin expansions driving a significant portion of the growth.

Noteworthy sectors like Tech, Finance, and Consumer Discretionary are expected to see enhanced margins in 2024. The positive margin outlook reflects ongoing sectoral advancements and the potential benefits of AI on productivity.

Concluding Thoughts

The upcoming earnings reports for Meta and Microsoft are anticipated to garner close attention, mirroring the scrutiny faced by Alphabet and Tesla. Investors are likely to focus on tangible returns from AI investments and the overall profitability of tech companies.