Apple (NASDAQ: AAPL) has long towered as the world’s top company, with a market capitalization of about $3 trillion, dwarfing the much smaller Nvidia (NASDAQ: NVDA) valued at $1.2 trillion. Apple has been a behemoth, but Nvidia is a rapidly growing contender, leading to speculation about whether Nvidia could eclipse Apple in valuation by 2030.

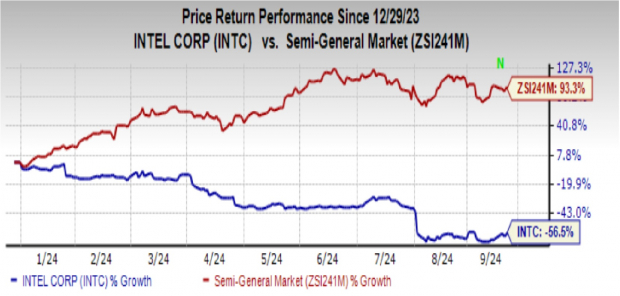

These titans differ significantly, with Nvidia’s meteoric rise contrasting Apple’s dwindling revenue, prompting debate on the possibility of Nvidia outpacing Apple.

Apple’s Dominance in Revenue

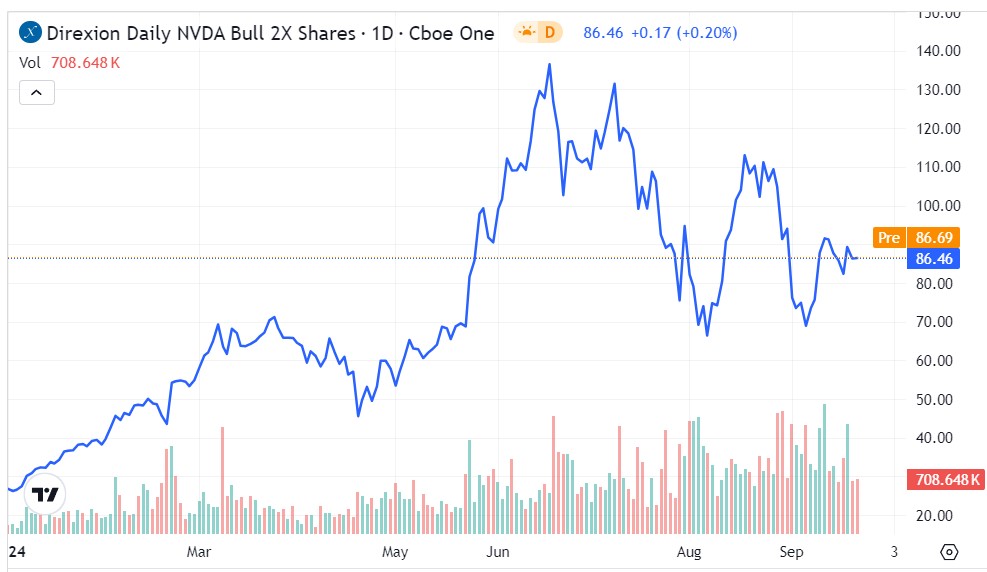

Apple’s ubiquity is undeniable, with iPhones, Macs, and AirPods being consumer favorites. In contrast, Nvidia, renowned for its graphics processing units (GPUs), initially tailored for gaming, expanded swiftly to encompass applications in engineering simulations, cryptocurrency mining, and artificial intelligence (AI) model creation. Nvidia’s explosive revenue growth of 206% in the third quarter of fiscal 2024 and a subsequent stock appreciation of almost 240% testify to its ascendancy.

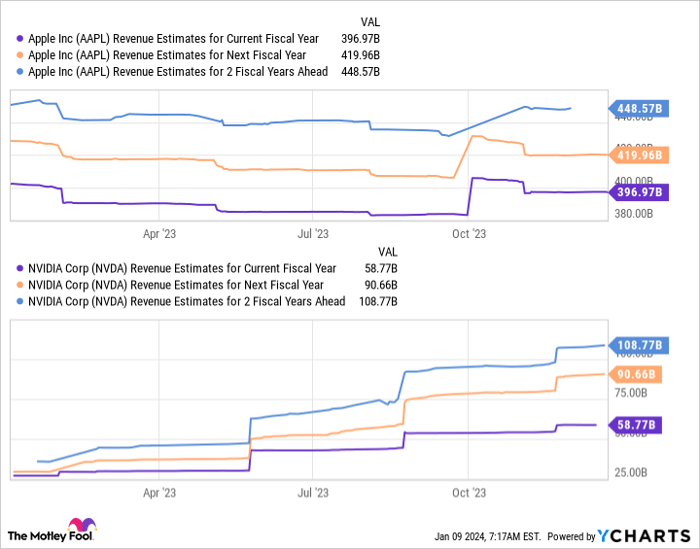

Nevertheless, despite this growth, Nvidia’s revenue pales compared to Apple’s staggering financial might. While Nvidia’s projected fiscal year 2026 revenue is around $109 billion, Apple’s current trailing 12-month revenue stands at $383 billion, presenting a substantial disparity. However, valuing companies based solely on sales would elevate commerce entities like Amazon and Walmart over Apple due to their higher sales, necessitating an evaluation of profit margins.

Nvidia’s Profit Potential

From a profitability standpoint, Nvidia boasts an edge over Apple, evidenced by their respective profit margins of 51% and 26%. This means Nvidia converts more than half of its revenue into pure profit, indicating a promising trajectory that is expected to persist. Notably, Nvidia’s profits are poised to escalate at a much faster pace than its revenue, while its stock is likely to garner a higher price-to-earnings valuation.

Applying this analysis to the revenue forecasts, if Nvidia achieves the projected $109 billion in sales for fiscal year 2026 with a 50% profit margin, it could generate $54.5 billion in profits. Similarly, if Apple attains its estimated target with a 25% margin, it would yield $112 billion in profits. Factoring in Nvidia’s superior growth rate and profitability, it would warrant a premium valuation over Apple, setting the stage for a potential shift in market dominance.

The Caveats

Despite Nvidia’s promising trajectory, an integral consideration pertains to its cyclical nature. Unlike Apple, which benefits from a growing subscription-based model, Nvidia faces the challenge of sustaining revenue levels owing to the cyclical demand for GPUs. This factor casts doubt on the feasibility of Nvidia’s ascension, suggesting that it is improbable despite its favorable growth trajectory.

Thus, while Nvidia could feasibly surpass Apple in the future, the caveat of its cyclical nature presents a formidable barrier, tempering expectations regarding its growth trajectory.

A Thoughtful Investment Approach

Before considering an investment in Nvidia, it is paramount to weigh the factors discussed above. While the future trajectory appears promising, prudence dictates a cautious stance, especially considering the cyclical nature of Nvidia’s business. Investors must evaluate the potential barriers to Nvidia’s projected growth before making informed investment decisions.