The Trillion-Dollar Hydra: Hydrogen Market Insights

Could we see a trillion-dollar behemoth rise in the hydrogen market by the time 2050 rolls around? Deloitte and McKinsey & Co. certainly believe so, heralding the advent of a new era where hydrogen takes center stage as a linchpin of the global economy. Industry experts forecast significant growth in hydrogen demand, with the potential to unleash a trillion-dollar market monster. Amidst this volatile landscape, Plug Power (NASDAQ: PLUG) emerges as a titan in the hydrogen industry, drawing attention from investors hungry for its speculated future growth.

A Glimpse into the Hydrogen Haven

The horizon of the hydrogen market appears promising, with projections pointing to substantial expansion by 2050. Considered an elixir for challenging sectors known as “hard-to-abate,” hydrogen’s allure stems from providing a viable alternative for industries reliant on fossil fuels for high heat production. Deloitte’s research suggests that decarbonizing crucial sectors such as steelmaking and aviation demands a six-fold increase in global hydrogen usage to approximately 600 million tons by 2050. If these prophecies hold true, the hydrogen market could burgeon into a $1.4 trillion colossus by 2050. Growth spurts are expected sooner, with demand poised to double by 2030, triggering market values to soar to $642 billion.

Decoding Plug Power’s Success Saga

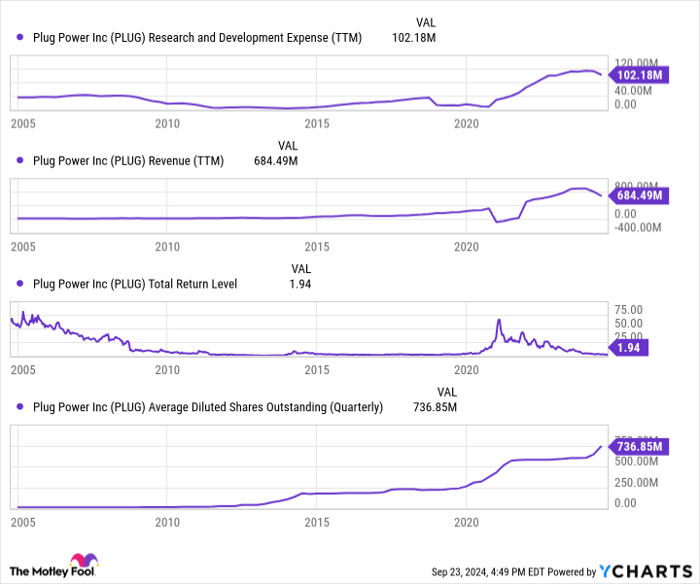

The allure of hydrogen’s long-term prospects is undeniably tantalizing, yet investing in this realm poses formidable challenges akin to the trials faced by electric vehicle ventures. While certain pioneers like Tesla have thrived, a graveyard of failed startups shadow the industry’s success stories. In this regard, Plug Power’s trajectory over the past two decades provides a cautionary tale of relentless share dilution, escalating by a staggering 9,950%, tarnishing long-term shareholder returns. Battling to secure its position, Plug Power grapples with the arduous task of amassing billions in financing to fortify its competitive stance against an unpredictable future.

A Murky Forecast for Plug Power

Despite the surging hydrogen demand on the horizon, Plug Power navigates treacherous waters marked by lingering uncertainties. The glaring issue lies in the arduous pursuit of rapid market growth to appease shareholders amidst mounting losses. Fending off financial peril with share dilution lifelines and governmental patronage, Plug Power’s journey continues plagued by unpredictable market dynamics. Encumbered by an equity duration estimation of 25.8 years, the company resembles a long-term investment bond, vulnerable to market volatilities and disruptive technological advancements that could potentially render its innovations obsolete.

Navigating the Investment Landscape

As the future unfolds, Plug Power grapples with existential threats, as signaled by a recent going concern notification. While the company may endure and possibly thrive in the expansive hydrogen milieu, savvy investors hedging their bets seek fertile ground elsewhere. The tantalizing allure of a trillion-dollar valuation in 2050 for Plug Power appears as elusive as chasing shadows, with an uncertain arena where competitors loom, R&D budgets stagnate, and financial perils persist.

Insights for Potential Investors

Contemplating an investment in Plug Power necessitates a discerning eye. Before diving into the turbulent waters of Plug Power stock, a prudent move is to ponder the wisdom imparted by the Motley Fool Stock Advisor. While Plug Power may appear a tempting prospect, the ten stocks spotlighted by industry analysts boast the potential for substantial returns, underlining the imperative for investors to tread cautiously amidst murky market waters.