Few stocks have outperformed the “Magnificent Seven” in recent years. All seven have seen their share prices rise by more than 400% during the past decade; some have even skyrocketed by nearly 20,000%!

Only one stock among the seven — Tesla (NASDAQ: TSLA) — has posted a negative return during the past three years, losing roughly 16% of its value.

The Potential $1 Trillion Stock

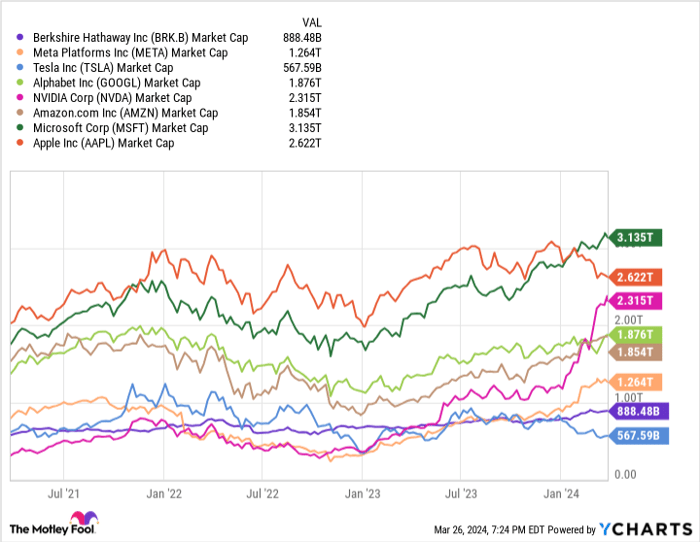

Many of today’s trillion-dollar companies are completely focused on technology. The Magnificent Seven currently includes Alphabet, Meta Platforms, Apple, Amazon, Nvidia, and Microsoft — all pure plays on the rise of technology. Tesla, the one member of the group with a market cap of less than $1 trillion, is arguably the least tech-focused business.

It might come as a surprise, but Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) makes a lot of sense as a Tesla replacement. With the company’s market cap at nearly $900 billion, its shares would only need to rise another 13% to surpass the $1 trillion mark. That could happen as early as this year.

Tesla, meanwhile, currently has a market cap of about $570 billion. That’s still huge, but purely from a size standpoint, Berkshire fits the Magnificent Seven mold better than Tesla.

You might be asking: Isn’t Berkshire even less of a tech company than Tesla? The answer could surprise you.

At its core, Berkshire is essentially an insurance business with an investment arm. That doesn’t sound like a tech company, but the top holding in its publicly traded investment portfolio is actually a Magnificent Seven stock: Apple. That stake is currently worth about $168 billion — nearly 30% of Tesla’s current market cap.

And that isn’t Berkshire’s only tech position. It also owns around $1.8 billion in Amazon stock, $970 million in Snowflake shares, $2.3 billion in Visa, $1.9 billion in Mastercard, $685 million of HP stock, and $1.3 billion in Nu Holdings shares. The conglomerate even owns $2.4 billion in BYD, an electric vehicle company that competes directly with Tesla in China.

To be sure, Berkshire is hardly as tech-focused as the rest of the Magnificent Seven. Even when all of its technology investments are combined, they still represent a value of less than $200 billion. Still, that’s nearly one-quarter of Berkshire’s market cap, making it much more of a tech-focused stock than many might realize.

A Wiser Investment

It can be very difficult to compare Tesla and Berkshire directly. Each business makes money in entirely different ways, requiring different valuation methodologies. What we can do, however, is compare how expensive each stock is relative to its peers.

Compared to traditional automakers like Ford, General Motors, and Volkswagen, Tesla stock is hardly a bargain. Even compared to other electric vehicle manufacturers like Rivian, it is still priced at a steep premium.

Berkshire is also priced at a premium to many of its competitors, but that premium is significantly less. On a price-to-book basis, the shares trade at a 20% to 50% premium to similar businesses. Tesla, for comparison, trades at nearly a 200% premium compared to Rivian on a price-to-sales basis.

It’s unlikely that Berkshire will ever join the Magnificent Seven; it simply isn’t focused on technology enough to warrant consideration. But as we’ve seen, it’s more heavily invested in tech than most people might realize.

Even after a sharp decline, Tesla stock remains relatively expensive, while Berkshire Hathaway shares are priced reasonably given its long track record of success. It may not replace Tesla in the Magnificent Seven anytime soon, but it should replace Tesla in your personal portfolio.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024