Investors have witnessed a recent surge in Chinese electric vehicle (EV) stocks in recent weeks, with notable movements in Xpeng Motors (XPEV) amidst a challenging market landscape. Despite a 21% monthly rally, XPEV remains down 43% for the year, reflecting market volatility.

Analyzing XPEV Stock Surge

Xpeng’s Q2 earnings and the expansion of its gross margins to 14% have garnered positive attention. The company’s commitment to achieving stable margins in the second half of the year, along with the CEO’s substantial stock purchase, fueled investor optimism, propelling the stock upward.

The launch of the Mona M03 electric coupe, priced below $17,000, further fueled excitement, with 10,000 orders secured within one hour of release. Additionally, XPEV benefitted from NIO’s robust Q2 earnings, demonstrating the interconnectedness of the Chinese EV market.

Insights into Xpeng 2025 Forecast

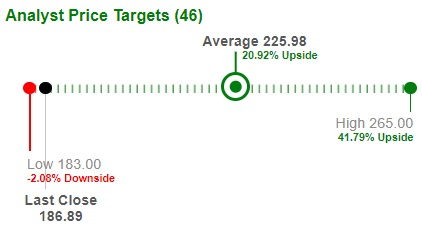

Wall Street’s increasing confidence in Xpeng is evident, with JPMorgan upgrading the stock to “overweight.” Analysts foresee a promising future, projecting a 45% rise in the stock price. Despite underwhelming 2024 deliveries, several catalysts support a positive outlook:

- Expanding Deliveries: New models like the Mona M03 and P7 sedans are set to drive Xpeng’s 2025 deliveries to 300,000 units, showcasing a 72% increase from this year. These models target a slice of the budget EV market currently dominated by BYD.

- Global Expansion: Xpeng’s international sales exceeding 10% of total revenue in Q2 signal a strategic shift. Plans to enter 40 markets by year-end and potentially establish an EU plant bolster its market presence.

- Volkswagen Partnership: Collaboration with Volkswagen to develop cars for the Chinese market by 2026 promises mutual benefits and supports XPEV’s ambitions for global expansion.

- Autonomous Driving: Xpeng’s autonomous driving technology, though underappreciated by markets, presents a valuable asset that could reshape the company’s future trajectory.

Assessing XPEV Investment Potential

Despite past volatility, Xpeng offers a compelling investment case driven by future launches and revenue growth opportunities. Analysts anticipate a substantial revenue surge in 2025, paired with improved profitability. Trading at 1.1x its next 12-month sales, XPEV’s valuation appears reasonable, given its growth potential.

The upcoming year will be critical for Xpeng Motors, as it aims to validate its market position with new models and margin enhancements. While uncertainties persist, successful execution could pave the way for a prosperous 2025. Investor sentiment remains cautious, emphasizing the demand for consistent results in the competitive EV landscape.