The Strength of Consumer and Business Finances

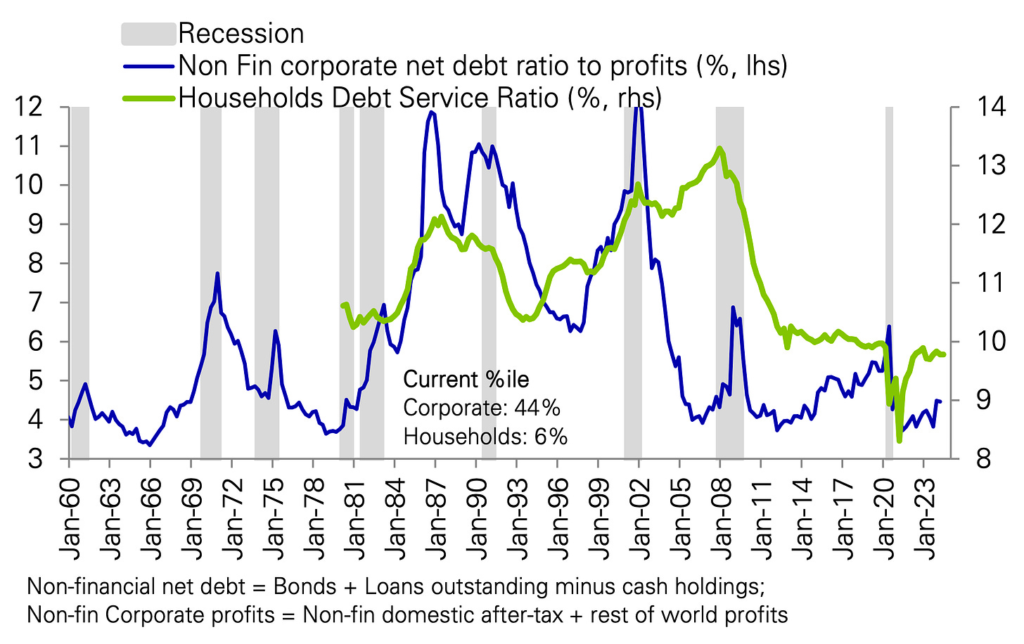

Consumer and business finances depict a picture of robustness. According to Deutsche Bank’s Binky Chadha, the current state of household and corporate balance sheets stands in stark contrast to previous economic downfalls. This foundation of strength bodes well for continued economic activity, with consumers having the capacity to sustain spending levels.

The Stock Market’s Independence from Political Tides

Despite expectations of stock market movement based on political figures like Donald Trump, recent trends suggest a decoupling. RBC’s research indicates that the stock market rally persists even as Trump’s election prospects decline. History echoes this phenomenon, showing that businesses can thrive irrespective of the prevailing political climate, eventually leading to growth in earnings and stock valuations.

The Dominance of Compound Interest Over Partisan Politics

The impact of political party affiliations on stock market performance is eclipsed by the power of compound interest. BlackRock’s Gargi Chaudhuri emphasizes the significance of staying invested for long-term wealth creation, highlighting how consistent investment outperforms market timing strategies based on electoral cycles.

The Superiority of U.S. Corporations in Global Markets

Comparisons between U.S. and European companies reveal a stark reality: no European company established within the last 50 years boasts a market capitalization exceeding €100 billion, in contrast to the emergence of several U.S. giants with valuations above €1 trillion. This disparity underscores the exceptional growth and innovation prowess of American corporations. Deutsche Bank’s Jim Reid underscores the U.S.’s conducive environment for corporate success, attributing it to factors such as innovation culture, business-friendly regulations, and sound corporate governance practices.

Insightful Analysis on Financial Trends

Global Business Dynamics

Shareholders are the subtle puppeteers, enticing company executives and employees to dance to the tune of rising earnings. This symphony of profitability has transformed investing in the U.S. stock market into a perennial winner, an enduring tale of triumph likely to echo through the annals of time.

The International Business Canvas

In the realm of commerce, borders wield little influence over the operations of multinational corporations. While the United States flaunts its economic might, businesses across the U.K., Europe, and Japan conduct a significant portion of their affairs beyond their native shores. International revenue streams flow abundantly, illustrating how companies can thrive through global ventures without solely traversing foreign stock markets.

Speculating on Job Openings

The labor market, once ablaze with a surplus of job opportunities, now simmers to a calmer pace. Will a resurgence in job openings reignite the embers of employment? Signals from staffing firm stock prices hint at a potential revival, yet this solitary metric stands juxtaposed against a backdrop of tepid labor market indicators. Could the recent Federal Reserve rate cut fan the flames of a labor market resurgence?

Navigating the Innovation Landscape

Comparing Nvidia’s surge in the age of artificial intelligence to Cisco’s bygone glory during the Dotcom era finds little common ground. Unlike the dot-com darlings of yesteryears, Nvidia boasts not just soaring valuations but tangible earnings growth, a testament to the insatiable demand for AI technology. Industry experts foresee AI technologies fueling profit margins, a promise that only time will unfold.

Labor Cost Chronicles

Within each industry beats a unique financial heart, dictating the cost of labor essential for sustenance. A peek behind the curtains of S&P 500 reveals that labor expenses range from 3% in Energy to a formidable 20% in Industrials. Understanding this labor cost labyrinth sheds light on the repercussions of wage variations across sectors.

Financial Fortunes Forecast

Amidst the ever-evolving financial tapestry, a beacon of hope emerges as profit prospects ascend. Earnings per share for the S&P 500 gaze skyward, heralding a promising outlook that stands 10% higher than the bygone year. As earnings continue to steer the tumultuous waters of the stock market, the future unfolds like a tapestry of opportunity, waiting to be woven by farsighted investors.