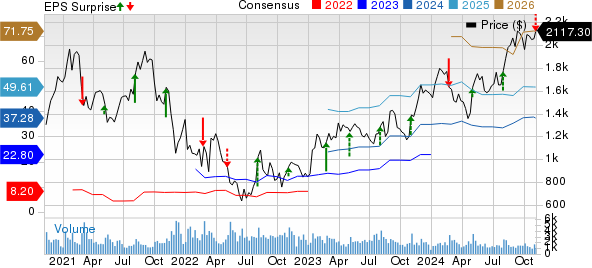

Among the “Magnificent Seven” stocks, Tesla (NASDAQ: TSLA) is the only one that has not posted a double-digit return so far in 2024. While there have been some notable rises in Tesla stock at different periods this year, shares are up just 4% as the end of October nears.

Despite these uninspiring gains, Tesla CEO Elon Musk is more bullish than ever. During the company’s third-quarterearnings call Musk told investors he thinks “Tesla will become the most valuable company in the world, and probably by a long shot.”

While I appreciate Musk’s confidence, is such a remark reasonable? Well, it actually might be.

I’ll detail what catalysts Tesla has and explain how these initiatives could bring significant upside to the company’s valuation.

How can Tesla supercharge the business?

Tesla’s main sources of growth right now come from its electric vehicles (EV), as well as its power storage business. Although Tesla is a leader in both these markets, automobiles and green energy infrastructure are not enough to propel Tesla to the world’s most valuable business.

The main catalyst that can supercharge Tesla to the next level is artificial intelligence (AI). Right now, Tesla’s two primary areas of AI investment are in autonomous driving technology and humanoid robotics.

Let’s take a look at how self-driving cars and robotics can positively impact Tesla’s valuation.

Image source: Getty Images.

How will AI change Tesla’s valuation?

Autonomous driving stands to be a game changer for Tesla. On the surface, the obvious tailwind from this technology is that it may inspire more people to purchase a Tesla over a vehicle made by another manufacturer. However, self-driving technology has the potential to be much more than a nice amenity.

Namely, Tesla is looking to build a fleet of Robotaxis. The long-term vision is that Tesla will have fleets of driverless cars on the road that can be used for a variety of applications besides everyday driving. For instance, Tesla could market its Robotaxis to delivery services, rental car businesses, or even ride-hailing platforms.

The real moneymaker here is not just from the accelerated sales that Tesla could witness should the Robotaxi initiative come to fruition. Rather, the company’s autonomous driving software should carry a much higher profit margin profile compared to the stand-alone automobile business. Rising margins should flow directly to the bottom line, enhancing Tesla’s net income and free cash flow.

In my eyes, layering software margins on top of the legacy business could lead to investors placing a premium on Tesla’s valuation, as the company would no longer be seen as simply a carmaker.

Outside autonomous driving, Tesla is also pursuing humanoid robots. This project is known as Optimus, and Musk himself has touted that it “has a good chance of being the most viable product that we made.”

The idea here is that humanoid robots will be placed in Tesla’s factories and assist human workers with mundane and generic tasks, thereby driving productivity levels higher. In theory, these productivity efficiencies can help Tesla produce and deliver more vehicles at faster rates.

If Optimus winds up being successful, Tesla could very well license out the technology to other manual labor-intensive businesses in warehouses or logistics. Considering humanoid robotics is a relatively new concept and stands to be a novel technological breakthrough, Tesla’s valuation could witness some outsized expansion if the company executes on this vision.

Is Tesla stock a buy right now?

A couple of months ago, I wrote a piece in which I covered a remark from Musk that likely rattled a lot of investors. Essentially, the outspoken entrepreneur told investors that they should not buy Tesla stock if they don’t believe in the company’s AI vision.

It’s pretty clear at this point that Musk does not see Tesla as just a car or green energy business — he’s gone all-in on AI, and sees the technology as the bridge that will connect all of Tesla’s various segments. If autonomous driving or humanoid robotics doesn’t pan out, I suspect shares of Tesla could witness an epic, historic sell-off.

While I personally view Tesla stock as a compelling opportunity, I’ll concede that it’s not for the faint of heart. With that said, I think Elon’s prediction of Tesla becoming the world’s most valuable company will come true.

As I’ve written on several occasions, I’ve been a Tesla shareholder for many years and do not intend to sell my stock anytime soon. I think Tesla is in the early stages of a generational transformation, and I’m optimistic that the long-run tailwinds from these technologies are not yet fully baked into Tesla’s valuation.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 807% — a market-crushing outperformance compared to 167% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of October 28, 2024

Adam Spatacco has positions in Tesla. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.