As the legendary “Magnificent Seven” stocks continue their upward trajectory, some investors are starting to question whether the magic is starting to fade. While these stocks have been showing consistent growth, the rates are beginning to taper, hovering below the 10% mark.

Despite their majestic status, the lofty valuations of these companies might be causing some reluctance among investors. Yet, hidden within the Magnificent Seven lies a potential treasure trove for those willing to dig deeper.

Insights into Analyst Projections for the Magnificent Seven

Diving into the consensus analyst price targets for each of the Magnificent Seven can offer valuable insights into the growth potential of these stocks, based on their closing prices from the previous week.

| Stock | Price Target | Upside % |

|---|---|---|

| AAPL | $205.27 | 19% |

| AMZN | $197.95 | 13% |

| GOOG | $146.33 | 3% |

| MSFT | $415.00 | 0% |

| META | $494.53 | 2% |

| NVDA | $829.66 | (6%) |

| TSLA | $211.93 | 30% |

Source: MarketBeat. Upside based on closing prices from March 15, 2024.

While price targets provide a glimpse into the anticipated performance of a stock, they do not necessarily indicate an imminent reversal in fortunes. Take Nvidia, for example, which has seen a remarkable 80% surge in value this year. The seemingly conservative price target and negative upside projection may stem from the tech giant’s rapid growth. Nvidia’s future prospects could still make it an attractive investment, despite the subdued expectations.

On the other hand, Tesla’s allure as the top performer in the Magnificent Seven may be a result of its recent slump. The electric vehicle manufacturer has witnessed a 30% decline this year, attributed to shrinking margins, heightened competition, and macroeconomic uncertainties impacting EV demand. Analysts’ bullish stance on Tesla might not fully reflect these challenges, explaining the seemingly generous upside forecast.

Is Tesla the Diamond in the Rough Among the Magnificent Seven?

While Tesla’s current price targets may paint a rosy picture, delving into its projected earnings reveals a different narrative – one that positions Tesla as the priciest pick among its peers.

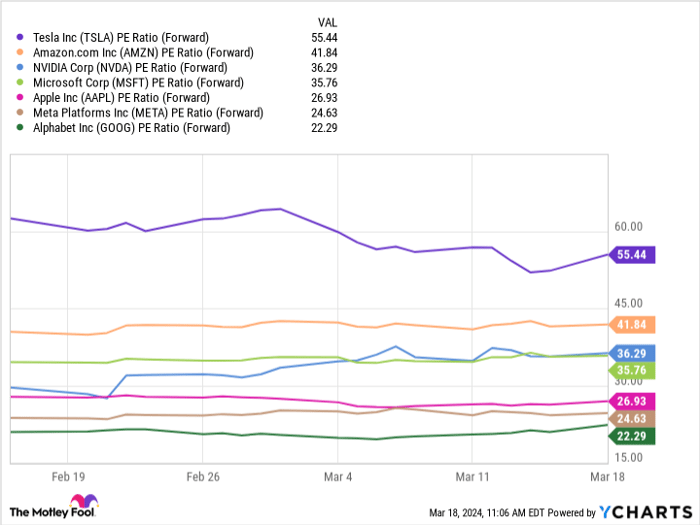

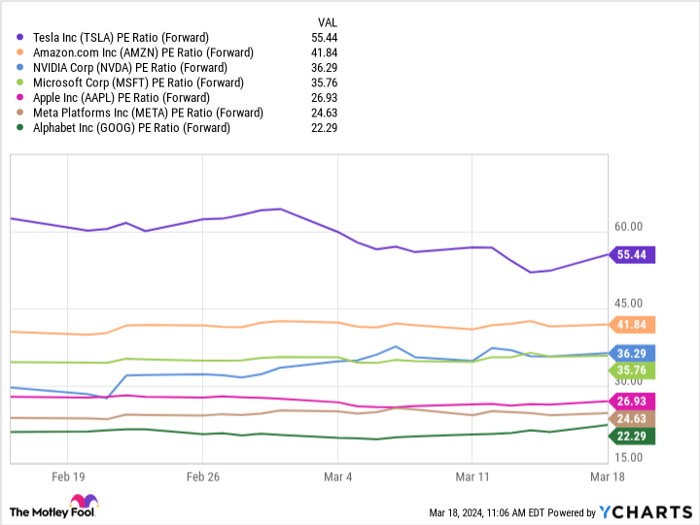

Forward PE Ratios data by YCharts

Scrutinizing the forward price-to-earnings multiples shines a light on Tesla’s premium valuation. Despite Nvidia’s strong profitability and anticipated growth, it surprisingly falls mid-range, showcasing a more balanced investment proposition.

Tesla: Deceptive Bargain or Risky Bet Among the Magnificent Seven

While Tesla holds promise for a potential rebound down the road, its current status flags it as the riskiest bet within the illustrious Magnificent Seven. Consider exploring alternative options within the list for a potentially safer and more lucrative investment path.

Investors are cautioned against relying solely on analyst price targets, which may lag behind rapidly shifting market dynamics. A falling stock may falsely shine with upside potential, as in the case of Tesla.

For long-term gains, consider diversifying towards promising investments like Nvidia with its cutting-edge AI technology or Amazon, poised for sustained growth in the e-commerce realm.

Deciding Where to Allocate $1,000 Today

With two decades of successful stock predictions under their belt, the analyst team’s recommendations carry weight. Their latest findings propose the 10 top stocks to consider right now, with Tesla making the cut – but don’t overlook the 9 other hidden gems.

*Stock Advisor returns as of March 20, 2024