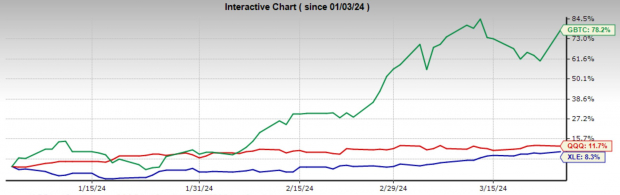

The US stock market is currently experiencing a remarkable surge, with the major indices up by almost 10% year-to-date, marking one of the strongest starts in recent memory.

The Energy Sector: Powering Ahead

Amidst this bullish environment, the energy sector has emerged as a dark horse, outperforming all others by posting a remarkable 9% rally in the last month alone. This surge can be attributed to the sustained strength of both the US and global economy, which is fueling a soaring demand for oil.

Moreover, with OPEC+ implementing production cuts and a steady decline in oil infrastructure, future production is expected to be constrained, thereby maintaining an upward pressure on oil prices.

Opportunities in Fuel: Energy Stocks on the Rise

Notably, certain oil companies such as Murphy USA and Sunoco are currently sitting pretty with a Zacks Rank of #1 (Strong Buy), making them prime picks amidst this energy boom. These companies have witnessed substantial appreciation in their stock prices, showcasing the potential for lucrative returns in the current market climate.

Despite a challenging year for the energy sector previously, the recent momentum in crude oil prices heralds a brighter future for profits in the industry.

Furthermore, the Energy Sector ETF (XLE) is on the brink of breaking out from a bullish technical pattern, indicating the possibility of further price upswings if it manages to secure a convincing close above its upper boundary.

The Tech Trend: A Dominant Force

Another star player in the market is the technology sector, exemplified by the stellar performance of the Invesco Technology ETF (QQQ). This ETF has delivered an impressive 19.3% annual growth over the past 15 years, showcasing its prowess as a top-performing investment vehicle.

The unrelenting march of technological innovations such as digital transformation, cloud computing, and Artificial Intelligence continues to fuel the sector’s growth, promising a sustained upward trajectory in the foreseeable future.

Leading Lights: Tech Giants Illuminating the Industry

While the tech sector boasts an array of dynamic growth stocks, the standout performers remain Amazon and Meta Platforms. These industry stalwarts are poised to capitalize on major technological trends such as e-commerce, cloud computing, VR/AR, and digital advertising, propelling them to new heights.

With Meta Platforms sporting a Zacks Rank of #1 (Strong Buy) and Amazon holding a Zacks Rank of #2 (Buy), along with robust 3–5-year EPS growth projections, these companies stand out as formidable contenders in their space.

The Bitcoin Bonanza: A Digital Goldmine

Since 2017, Bitcoin has delivered a staggering return of nearly 10,000% to investors, marking a phenomenal 100x return on investment. Despite the inherent volatility, few assets can rival the wealth generation potential of this digital currency.

Bitcoin ETFs: Bridging the Gap to New Heights

The Future of Bitcoin

Bitcoin has shown remarkable growth, surpassing the $1 trillion mark in market capitalization. While such rapid compounding is unlikely to continue at the same pace, there are still promising returns on the horizon.

Unprecedented Returns

Over the past year, Bitcoin has exhibited exceptional performance, attracting investors with the advent of Bitcoin ETFs. This development marks a significant moment in cryptocurrency history, opening doors for a vast array of investors who were previously wary of diving into the market.

Challenging Gold’s Throne

Speculating on the next major milestone for Bitcoin, some experts believe it could surpass Gold’s market cap as they serve similar economic functions. Such a feat would propel the price of each Bitcoin to approximately $700,000, indicating a tenfold increase from current levels.

The Role of ETFs

ETFs provide a convenient route for investors to gain exposure to Bitcoin without worrying about security risks. Among the favored options is the Blackrock’s iShares Bitcoin ETF (IBIT), known for being the second-largest ETF and offering a more cost-effective option with a 0.25% annual fee.

Navigating the Bull Market

For those seeking a diversified approach to ride the current bull market wave, exploring sectors associated with Bitcoin could prove lucrative. Whether opting for ETFs for broad exposure or selecting leading individual securities within the sectors, strategizing a mix of these approaches might yield favorable results.