NVIDIA Corporation NVDA surpassed the monumental $3 trillion market capitalization on Wednesday, solidifying its position as a key player benefiting from the thriving demand for its cutting-edge chips for artificial intelligence (AI) applications. This remarkable achievement catapults the graphic processing unit (GPU) maker into an elite club, alongside tech giants like Microsoft Corporation MSFT and Apple Inc. AAPL, that boast market valuations exceeding $3 trillion, as of Jun 5.

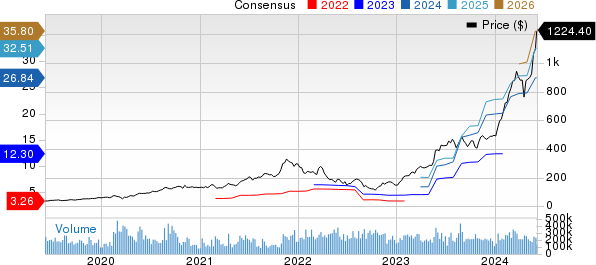

In a spectacular display of strength, NVDA stock surged 5.2% during yesterday’s trading, closing at $1,224.40 and attaining a market capitalization of $3.012 trillion. With this surge, NVIDIA zoomed past Apple, which sits at a market capitalization of $3.003 trillion, securing the position of the second-highest valued company in the U.S. market.

The incredible trajectory of NVIDIA is evident as its stock price has skyrocketed by a phenomenal 148.7% this year alone. With this powerful momentum, NVDA stock stands poised to potentially overtake Microsoft’s market capitalization of $3.151 trillion in the near future, cementing its dominance as the highest-valued company in the U.S. market. Impressively, NVIDIA achieved the $3 trillion milestone in just around three months from its $2 trillion market capitalization as of March 1, 2024.

Navigating NVIDIA’s Trajectory

The unprecedented surge in NVIDIA’s stock price is a testament to the unshakeable faith investors have in the company’s strategic prowess, stellar financial performance, and pivotal role in spearheading groundbreaking technologies like AI, gaming, and data center solutions.

The Promise of Generative AI

NVIDIA’s stellar stock performance is fundamentally underpinned by the growing belief that the company stands to reap substantial rewards from the expanding investments in generative AI. With generative AI offering a wealth of opportunities and NVIDIA’s commanding presence in this arena, NVDA stock appears set to maintain its upward trajectory throughout the year.

The uptick in demand to modernize operations across various sectors is anticipated to drive the adoption of generative AI applications. Projections indicate that the global generative AI market is set to swell to $967.6 billion by 2032, with an expected CAGR of 39.6% from 2024 to 2032.

The era of generative AI necessitates profound knowledge for content creation and significant computational power. As enterprises gear up to develop generative AI-based solutions, the enhancement of their network infrastructure becomes imperative.

NVIDIA’s cutting-edge chips, boasting superior computing capabilities, emerge as a natural choice for enterprises. Leveraging its GPUs in AI models, NVIDIA is expanding into uncharted territories such as automotive, healthcare, and manufacturing, thereby broadening its market reach.

The generative AI wave is poised to fuel extensive demand for NVIDIA’s high-powered next-gen chips. With burgeoning investments in AI across the data center landscape, NVIDIA anticipates its Q2 fiscal 2025 revenues to surge to $28 billion from $13.51 billion in the corresponding period last year.

Evaluating the Future

Emboldened by its robust product lineup, leadership position in AI, and continuous innovation streak, NVIDIA emerges as an enticing investment prospect. The company’s sterling reputation in the market coupled with its potential for sustained growth makes it an appealing choice for astute investors looking towards the long haul.

When considering NVIDIA’s long-term expected earnings growth rate standing at an impressive 36.7%, far outstripping the Semiconductor – General industry’s rate of 18.6%, and the company’s track record of consistently surpassing Zacks Consensus Estimates over the last four quarters, it becomes evident that NVIDIA is in a robust financial position. As of April 28, 2024, NVIDIA boasted substantial cash reserves amounting to $31.44 billion, up from $25.98 billion on January 28, 2024.

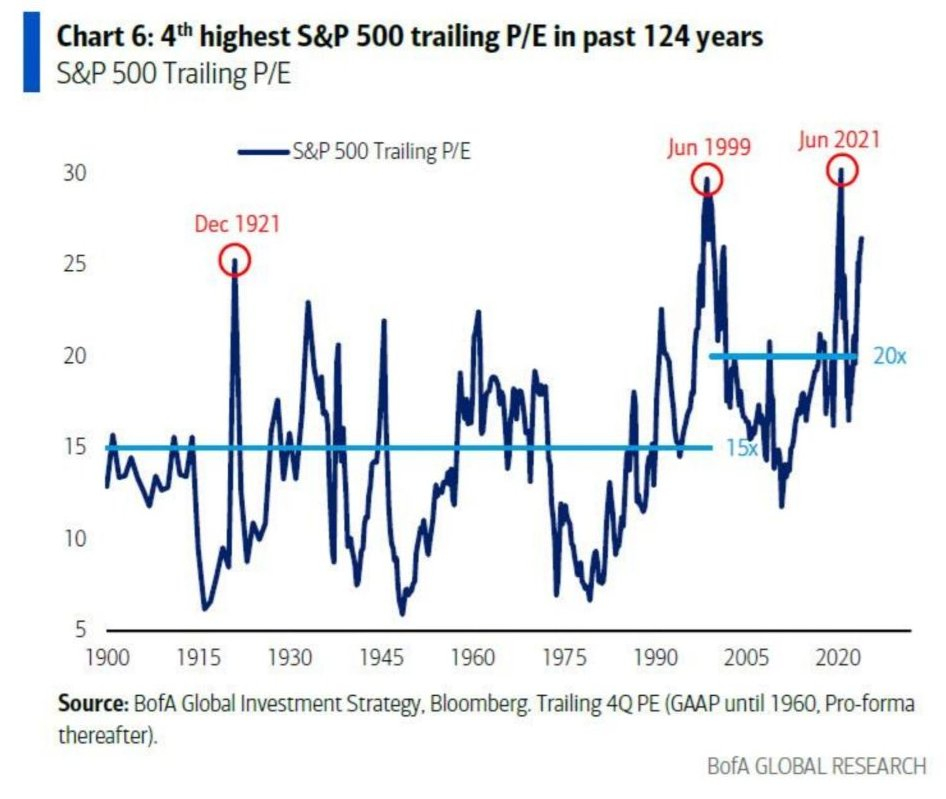

Despite NVIDIA’s stock trading at a one-year forward price-to-sales (P/S) ratio of 24.02, notably higher than the Semiconductor – General industry’s forward P/S ratio of 16.37, this premium is arguably justified given NVIDIA’s stellar financial performance and significant growth prospects in burgeoning sectors like automotive, healthcare, and manufacturing.

Moreover, NVIDIA’s Zacks Rank #1 (Strong Buy) status, coupled with a Growth Score of A and a Momentum Score of B, signifies a compelling investment opportunity as indicated by Zacks’ analytical methodology.

Exploring Alternatives

For investors seeking further opportunities in the vast tech landscape, another top-ranking stock worth considering is CrowdStrike Holdings, Inc. CRWD. With a Zacks Rank #2 (Buy), a Growth Score of A, and a Momentum Score of B, CrowdStrike presents itself as a promising candidate in the technology sector.

CrowdStrike’s long-term expected earnings growth rate of an impressive 22.3%, surpassing the Internet – Software industry’s rate of 19.7%, coupled with a robust year-to-date rally of 34.1% for CRWD stock outperforming the Internet – Software industry’s 8.2% growth, augurs well for potential investors.

Highest Returns for Any Asset Class

It’s not even close. Despite fluctuations, Bitcoin has proven to be more lucrative for investors than any other decentralized, global form of currency.

While no guarantees exist for the future, historical data illuminates Bitcoin’s exceptional returns during presidential election years: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks forecasts another substantial surge on the horizon.

Hurry, Download Special Report – It’s FREE >>