Steady Growth and Order Backlog

With market demand and an order backlog of approximately 5,900 units valued at around $850 million, Blue Bird is experiencing notable growth. The company exited the second quarter of fiscal 2024 with nearly 500 electric orders in its backlog. Initiatives like product enhancements for EVs, new safety features, complexity reduction, and quality improvements are contributing to its success.

Risks to Consider

However, reliance on subsidies and grants poses a risk, potentially impacting future growth if government support diminishes. The company’s efforts to diversify sales beyond EPA initiatives, particularly through its joint venture with Generate Capital, are promising. Still, investors need to watch out for more non-EPA orders to mitigate risks effectively.

Positive Outlook and Recommendations

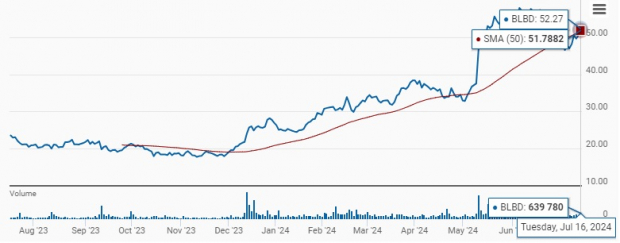

Despite these considerations, BLBD’s improved financial performance, manageable debt, and strategic alignment with market demands suggest a positive outlook. Investors should keep an eye on BLBD for potential gains, especially with the positive earnings revisions and technical strength observed in the stock.

Existing shareholders should hold onto the stock, while new investors may consider adding BLBD to their watchlist and initiating positions during market dips.

Final Thoughts

BLBD currently carries a Zacks Rank #3 (Hold) and has a VGM Score of A. Monitoring the company’s performance is crucial for investors looking to capitalize on its market position and growth potential. While risks exist, the company’s strategic initiatives and market alignment bode well for its future prospects.