Financial Outlook

Tesla (TSLA) is poised to unveil its second-quarter 2024 results on Jul 23, post-market close with an estimated EPS of 62 cents and revenues of $25.1 billion, modestly surpassing the previous quarter. Despite the 32% dip in earnings year-over-year, the company is expected to observe a 0.8% revenue increase.

Market Performance & Predictions

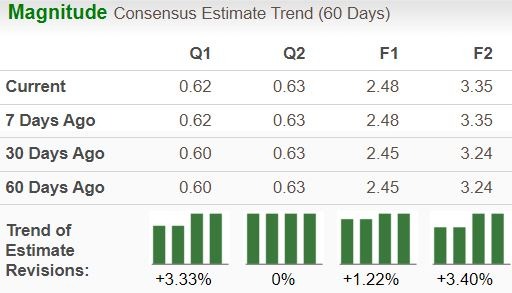

In the trailing year, Tesla witnessed fluctuating earnings performance, exceeding analysts’ projections on one occasion. With a 20.5% projected EPS contraction for 2024, the EV giant is treading on uncertain waters, posing a challenge for investors.

Insight into Q2 Earnings

Tesla’s second-quarter deliveries missed estimates but boasted a 15% quarterly surge. Financial forecasts predict a rise in automotive sales but highlight potential margin pressures from aggressive pricing strategies. Nevertheless, the Energy Generation/Storage segment has been a silver lining, showcasing substantial revenue growth upwards of 100%.

Comparative Analysis & Valuation

During the past six months, Tesla’s stock exhibited a resilient upward trend, outperforming sector averages and showcasing promising growth potential. However, with a price/sales ratio indicating overvaluation and an F-level Value Score, cautious optimism is warranted among investors.

Strategic Considerations

Tesla is navigating challenges associated with narrowing margins and market saturation. While growth projections for 2024 remain conservative, the company’s focus on AI-driven solutions and expansion into affordable vehicle offerings is a key aspect to watch. Moreover, the postponement of key events underscores the challenges Tesla faces in executing its ambitious roadmap.

Future Prospects

Investing in Tesla hinges on its AI and autonomous driving initiatives, with considerable risks around execution and market dynamics. The postponement of key milestones raises caution flags, underscoring the need for careful monitoring and due diligence among potential investors.

The Infrastructure Stock Revolution: Investing in the Rejuvenation of America

The Dawn of a New Era for Infrastructure Stocks

A monumental effort to revitalize the deteriorating infrastructure of the United States is on the horizon. This initiative is not only supported by both political parties but also deemed as urgent and unavoidable. Billions of dollars are poised to be allocated towards this mission, paving the way for substantial wealth accumulation.

Investors are confronted with the pivotal query: “Will you enter the right stocks at the opportune moment, maximizing their growth potential?”

Amidst this backdrop, the landscape of infrastructure stocks stands as a goldmine waiting to be unearthed. The potential for exponential growth in this sector is colossal, promising unprecedented returns for those who seize the moment.

Concrete Prospects or Fragile Foundations?

As the dust settles on the horizon, a quest for clarity pervades the minds of astute investors. The prevalent anticipation surrounding the future trajectory of infrastructure stocks beckons caution and prudence. In light of the current valuation of certain enterprises, exercising patience and vigilance before staking a claim in the stock market is a prudent strategy.

With the impending release of crucial details regarding the robotaxi project on July 23, the investment landscape stands to witness a seismic shift. For investors, the importance of waiting for a more cohesive outlook and favorable stability cannot be overstated.

Seizing the Moment – A Roadmap to Success

The journey towards financial prosperity amidst the infrastructure stock boom demands a strategic approach and foresight. Identifying and engaging with companies poised to benefit most from the reconstruction and refurbishment of roads, bridges, buildings, as well as advancements in cargo transportation and energy evolution is instrumental.

Charting a course towards profitable investments in line with the infrastructure resurgence requires meticulous navigation and astute decision-making. The value proposition lies in recognizing, in a timely fashion, the stocks that are on the cusp of exponential growth.

The Promise of Tomorrow Awaits

As history has shown, the groundwork for future financial success is often laid in the present. The upcoming surge in infrastructure spending beckons the discerning investor to seize this unique moment in time. By aligning investments with companies at the forefront of this transformative wave, the potential for substantial gains becomes a reality.

The allure of infrastructure stocks amid this renaissance is undeniable. What remains is the investor’s sagacity in identifying and capitalizing on this promising opportunity as the stage is set for fortunes to be made.

To read this article on Zacks.com, click here.