The stock market, akin to a bustling city square, is abuzz with the footfalls of Big Money investors painting the streets green with their buys. They are the titans, the behemoths, managing fortunes of millions, billions, and even trillions of dollars. Their actions, akin to the tides controlled by the moon, can make or break a stock’s trajectory.

The Allure of Small-Cap Stocks

Just like bees to honey, Big Money investors are swarming around small and mid-sized companies, their interest piqued by the promise of potential growth and profitability. These investors, akin to seasoned detectives, use sophisticated algorithms to trace the flow of funds, identifying the sweet spots that promise untapped returns.

Unveiling the Big Money Patterns

An illuminating chart showcased by Jason sheds light on the recent activities of Big Money investors, highlighting their focus on small-cap stocks valued at $50 billion and under. The chart, akin to a treasure map, reveals a striking trend – a staggering 81% of all Big Money buy signals have been emanating from these smaller stocks.

Jason delves into the data, pointing out that the buy signals surpass sell signals by a significant margin, foreshadowing a bullish future for small-cap stocks. With the Federal Reserve hinting at rate cuts in the coming months, the stage is set for the Big Money to orchestrate a symphony of investing in the small-cap realm.

The Golden Age of Small Caps

Jason, exuding confidence akin to a seasoned weather forecaster predicting clear skies, coins the current era as a “retirement accelerator window” for top-tier small caps. He anticipates a prolonged period of prosperity fueled by the Federal Reserve’s anticipated rate cuts, an economic landscape mirroring the conditions of successful rallies in the past.

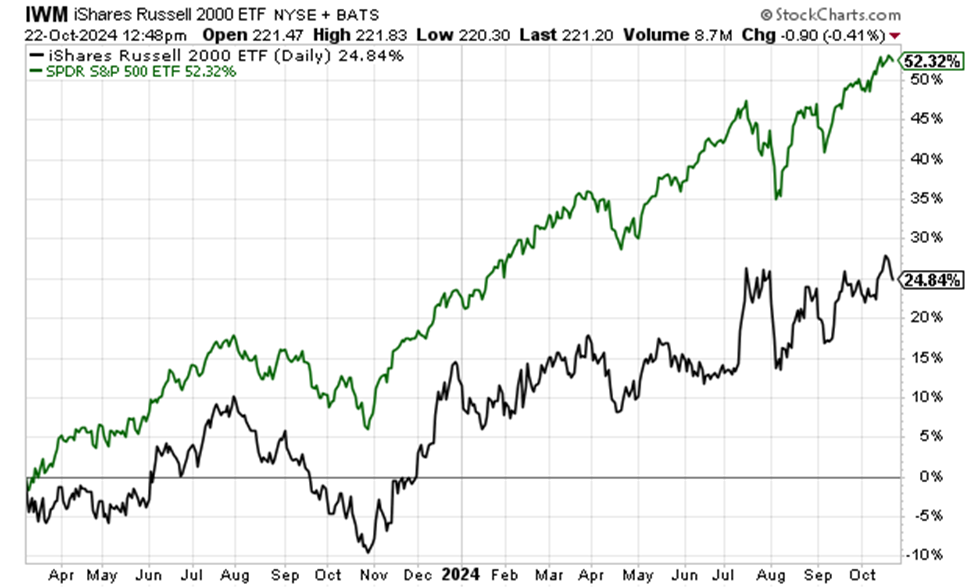

Jason’s thorough analysis not only points towards a robust 26.8% average rally in the S&P 500 post-rate cuts but also encapsulates the potential bonanza awaiting small-cap stocks. His findings reveal that the Russell 2000, the benchmark small-cap index, historically surged by an average of 36.6% over the subsequent two years post-rate cuts.

A Glimpse into Investment Opportunities

Highlighted through a comprehensive video bulletin, Jason’s research encapsulates the essence of rate cuts, the allure of small caps, and the predictive power of Big Money investments. His narrative, akin to a seasoned storyteller, unfolds the tale of potential returns lurking in the small-cap domain, waiting to be discovered by astute investors.

Embracing Wealth-Building Opportunities

With Louis echoing Jason’s sentiments, emphasizing the bountiful returns witnessed during similar “Retirement Accelerator Windows,” the stage is set for investors to seize the moment. Louis, akin to an experienced navigator, steers investors toward the compass pointing at substantial wealth-building prospects nested within the realm of small-cap stocks.

As Louis and Jason continue to unravel their research findings, promising to unveil potential investment gems, the spotlight shifts to the allure of small-cap stocks. In a crescendo reminiscent of a symphony’s finale, the clarion call is clear – align your portfolios with the tide of Big Money flowing towards small caps for a chance to ride the wave of historical outperformance.

As the stars of Wall Street realign, ushering in a golden age for small-cap stocks, investors are implored to encapsulate this historic surge within their investment portfolios, ensuring a seat at the table where giants feast on the potential bounties of the stock market.

As the sun sets over the horizon, casting a golden glow upon the bustling city of stocks, the curtain falls on another chapter of financial insights and opportunities.

May your investments blossom, like flowers in the spring,