Outside of Nvidia NVDA, all of the Magnificant-7-themed big tech stocks have already released their results for the Q3 period but this week’s earnings lineup features several intriguing large-cap stocks from a variety of sectors.

As leaders in their respective industries, here are three of these top large-cap stocks to buy with their quarterly results approaching on Wednesday, November 6.

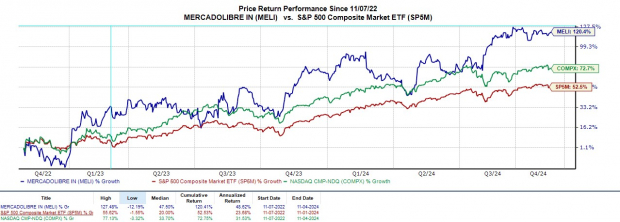

MercadoLibre – MELI

Starting in the retail sector, South American e-commerce leader MercadoLibre MELI is expected to have posted stellar growth during Q3.

Sporting a Zacks Rank #2 (Buy), MercadoLibre’s Q3 sales are anticipated at $5.25 billion, a 40% increase from $3.76 billion in the comparative quarter. More impressive, Q3 earnings are projected to soar 57% to $11.27 per share versus EPS of $7.16 a year ago.

MercardoLibre’s robust growth has kept investors engaged with high double-digit top and bottom line expansion in the forecast for fiscal 2024 and FY25. As one of the stock market’s top performers, MELI is sitting on +30% gains this year.

Image Source: Zacks Investment Research

Toyota Motor – TM

In terms of value, Toyota Motor’s TM stock is hard to overlook and boasts a Zacks Rank #1 (Strong Buy). As one of the leading automakers in the world, Toyota Motor’s stock trades at less than 1X sales with its top line thought to have increased 1% during Q3 to $79.78 billion.

Following a tougher-to-compete-against period, Toyota’s Q3 EPS is expected to decrease to $4.39 versus $6.54 a share in the prior-year quarter. However, TM trades at just 7.9X forward earnings with it noteworthy that Toyota has exceeded the Zacks EPS Consensus for seven consecutive quarters posting a very impressive average earnings surprise of 77.93% in its last four quarterly reports.

Image Source: Zacks Investment Research

Qualcomm – QCOM

Semiconductor-giant Qualcomm QCOM will be a stock to watch from the tech sector on Wednesday and sports a Zacks Rank #2 (Buy).

Integrating generative AI into all of its product lines, Qualcomm with be reporting results for its fiscal fourth quarter with Q4 sales projected to be up 14% to $9.9 billion. Plus, Q4 EPS is expected to spike 27% to $2.56. Standing out in terms of growth and value, QCOM trades at a very reasonable 15.1X forward earnings multiple especially when considering the premiums many chipmakers can command in comparison to the broader market.

Image Source: Zacks Investment Research

Bottom Line

MercardoLibre, Toyota Motor, and Qualcomm are three large-cap stocks that could pop if they can reach or exceed earning expectations while offering favorable guidance. Furthermore, they should remain viable long-term investments which could make them even more attractive if there is a post-earnings selloff.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report