The holiday season is rapidly approaching, with many consumers ready to get out there and shop. And several companies, including Amazon AMZN and Walmart WMT, could see a nice boost from the period thanks to their robust digital offerings.

Let’s take a closer look at each.

Amazon Gets Bullish on Holiday Season

Concerning headline figures in Amazon’s latest quarterly release, the company exceeded both consensus EPS and sales expectations handily. EPS grew 70% year-over-year, whereas sales of $60 billion reflected an 11% climb from the year-ago period.

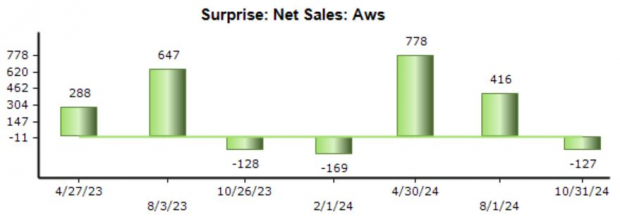

A big highlight of the results was the AWS results. AWS sales jumped 19% year-over-year to $27.5 billion, matching the same growth pace reported last quarter. The AWS results modestly fell short of our consensus estimate, as shown below.

Image Source: Zacks Investment Research

The company remains bullish about what It’s got in store for customers during the holiday season, kicking off the period with its biggest-ever Prime Big Deal Days and the launch of an all-new Kindle lineup that has broadly exceeded its initial expectations.

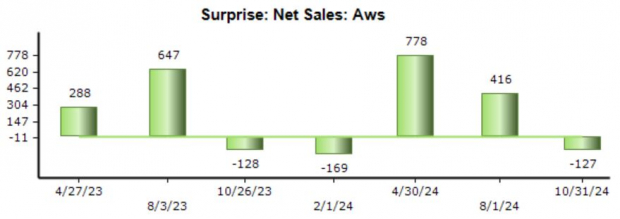

Impressively, Online Sales of $61.4 billion came in 3.3% ahead of expectations, snapping a recent streak of negative surprises on the metric.

Image Source: Zacks Investment Research

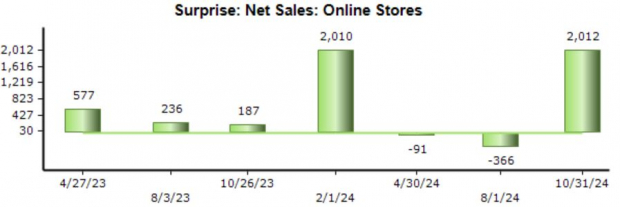

The company’s earnings outlook remains bullish, with the stock sporting a favorable Zacks Rank #2 (Buy) and enjoying positive earnings estimate revisions post-earnings.

Image Source: Zacks Investment Research

Walmart Keeps Shoppers Happy

Walmart’s latest quarterly release pleased investors in a big way, with the company’s digital efforts paving the way for robust results. Concerning headline figures, adjusted EPS jumped 14% higher alongside a 5.5% sales boost, continuing its recent growth trajectory.

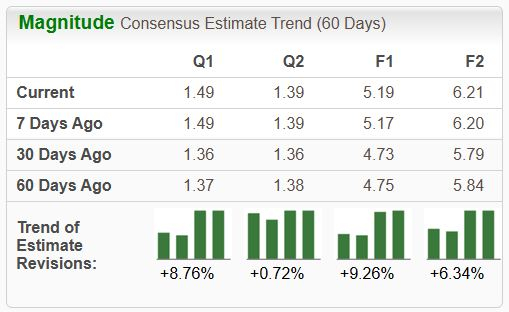

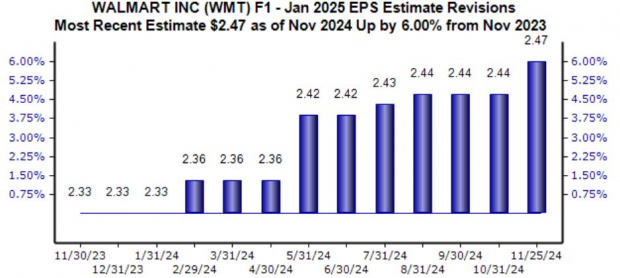

Analysts took a bullish stance on the company’s current year outlook following the print, with the $2.47 Zacks Consensus EPS estimate up 6% over the last year and suggesting 12% growth year-over-year.

Image Source: Zacks Investment Research

Notably, eCommerce sales were up 27% globally, with penetration higher across all segments and again confirming recent digital momentum for Walmart. Store-fulfilled pickup/delivery helped lead the robust digital showing, with consumers increasingly finding the service attractive.

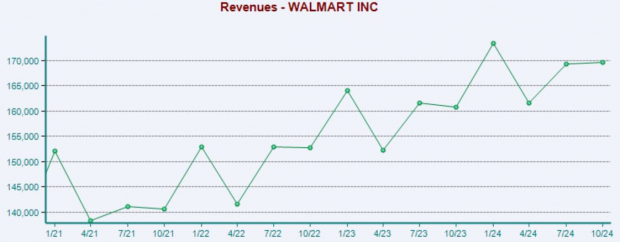

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

The company upped its FY25 net sales and operating income guidance following the release, helping explain the bullish share reaction post-earnings and the positive earnings estimate revisions.

Bottom Line

The holiday season has rapidly approached, with consumers undoubtedly ready to get out there and shop. And throughout the period, several companies could see tailwinds thanks to their digital and in-store offerings, including Amazon AMZN and Walmart WMT.

Amazon has long been a titan in the e-commerce space, establishing itself in a big way throughout the holiday seasons over the years. Walmart has also rapidly expanded its footprint concerning digital offerings, with the company also benefiting from the ‘trade-down’ development among higher-end consumers.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report